How to Offer Consumer Financing for Home Services: A Complete Guide

Learn how home service professionals can provide safe and seamless consumer financing options for their customers on big-ticket jobs.

Welcome to our complete guide on how to offer consumer financing for home services. Whether you're a contractor, plumber, electrician, or HVAC specialist, providing financing options to your customers can be a game-changer for your business.

Home services often involve expensive projects that homeowners may not have immediate cash to cover. By offering consumer financing, you can help your customers afford the services they need while boosting your sales and customer satisfaction.

In this guide, we will walk you through everything you need to know about offering consumer financing options. We'll explore the benefits, different types of financing, how to choose the right provider, and essential tips for successful implementation.

Our goal is to provide you with a comprehensive understanding of consumer financing, enabling you to confidently offer it as a payment option to your clients. With the right strategies in place, you can attract more customers, increase sales, and differentiate yourself from the competition.

Are you ready to take your home services business to the next level? Let's dive into the world of consumer financing and unlock its potential for your success.

What is Consumer Financing?

Consumer financing refers to the process of providing customers with financial options to pay for your home improvement, remodeling, or repair services over time.

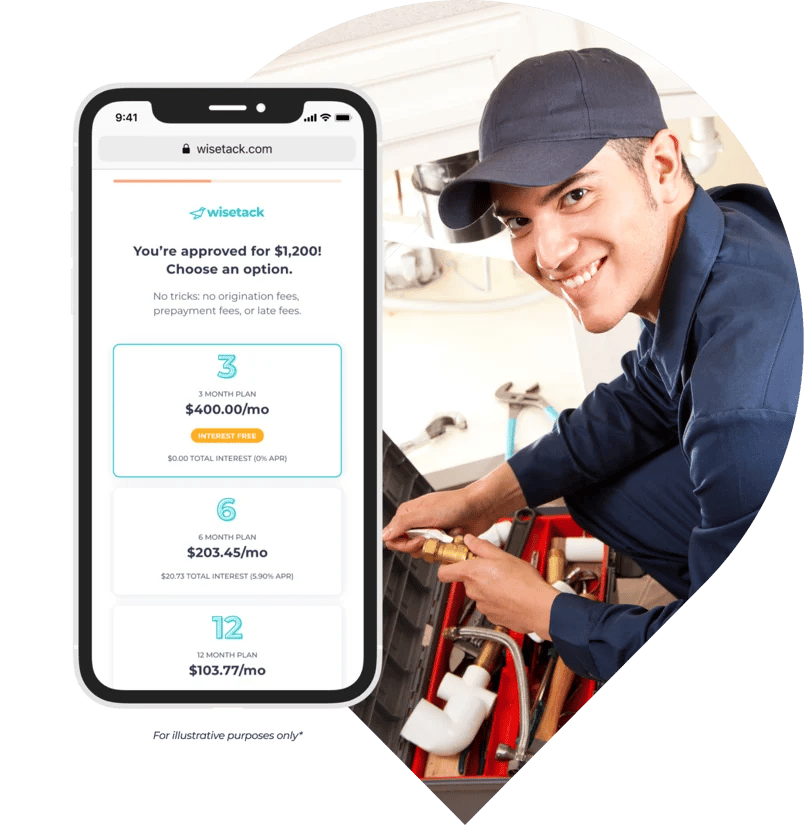

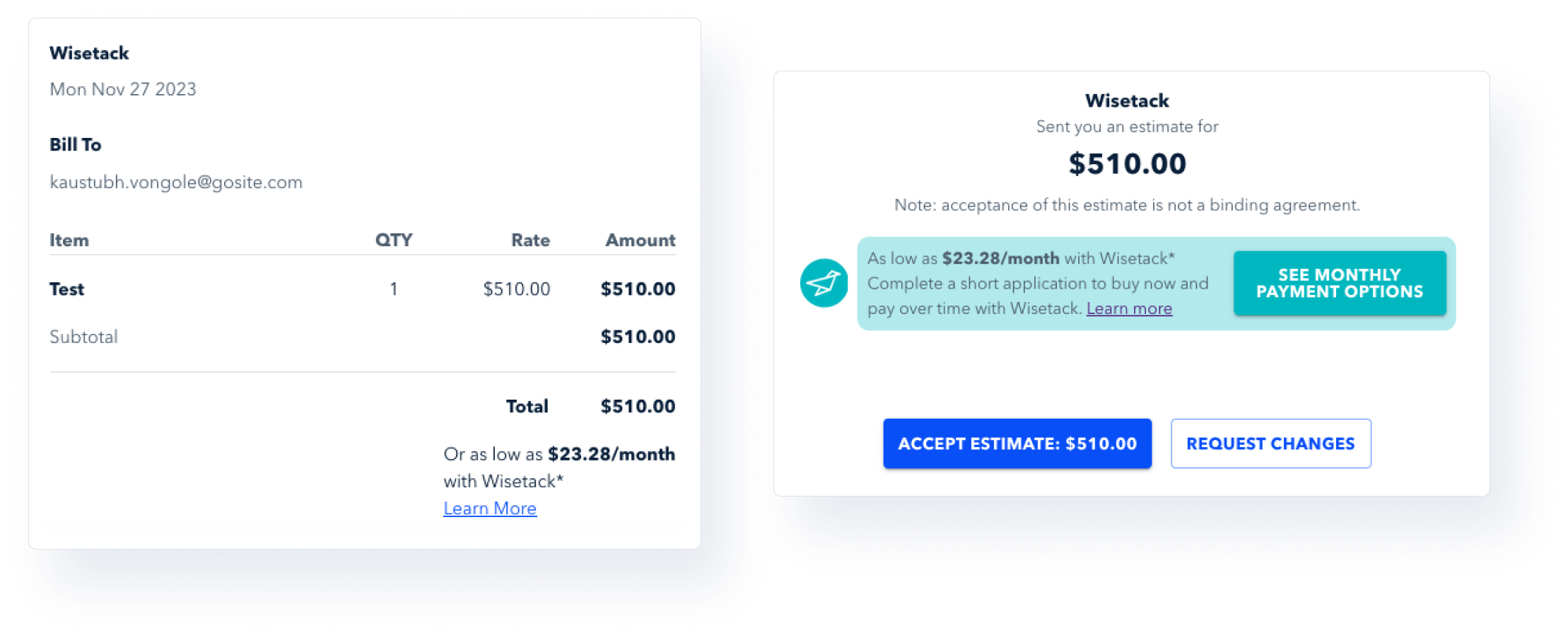

Here's an example of how that might work for a local service provider.

A homeowner decides to remodel their kitchen and receives quotes from several contractors. One contractor offers a financing option through a partnership with a third-party lender. The homeowner completes an online application and is pre-approved for a loan with a fixed interest rate and monthly payment plan.

Learn more about GoSite and Wisetack Financing

Learn more about GoSite and Wisetack Financing

The contractor proceeds with the kitchen remodeling project, and the homeowner makes monthly payments to the lender according to the agreed-upon terms. Once the project is complete, the homeowner has a fully remodeled kitchen and has financed the cost of the project over time.

Who is Consumer Financing For?

Consumer financing is not a one-size-fits-all solution for every home services business or customer. In this section, we will break down who might benefit the most from consumer financing.

Source: LendPro

Source: LendPro

Types of Home Services Businesses

- Businesses with high-ticket services: Consumer financing is especially advantageous for home services companies that provide high-priced services like extensive renovations, roof replacements, or HVAC installations. These types of projects can be financially unfeasible for numerous homeowners, and financing options can help make them more affordable and within reach.

- Businesses with a strong reputation: Trust is a crucial element in consumer financing, establishing a strong bond between businesses and customers. Companies that have established themselves with a reliable reputation and a track record of delivering exceptional services are more likely to attract customers who are open to financing their projects.

- Businesses with a focus on customer satisfaction: By providing flexible payment options and making services more affordable, offering consumer financing showcases a dedication to customer satisfaction. This approach can foster higher customer loyalty and generate positive word-of-mouth marketing.

Types of Customers

- Customers with limited upfront capital: Consumer financing is a great option for individuals who have limited initial funds but desire to make investments in home improvements or repairs. By opting for financing, customers can distribute the project's cost over a period, making it easier to handle financially.

- Customers with creditworthiness: In order to be eligible for consumer financing, customers generally require a satisfactory credit score. Nevertheless, there are alternatives accessible to customers with credit scores that are not ideal, including home equity loans or personal loans.

- Customers with a long-term perspective: Consumer financing is ideal for individuals who perceive home improvements or repairs as enduring investments that can augment the value of their property or improve their overall lifestyle. These customers are prepared to make monthly payments over an extended period, recognizing the advantages that the project will yield.

In summary, consumer financing is a valuable tool for home services businesses that cater to customers who want to finance their projects. It is especially beneficial for businesses with a strong reputation for quality services. To effectively utilize consumer financing and achieve success in the home services industry, careful consideration of business goals, customer needs, and financial options is crucial.

Benefits of Offering Consumer Financing

Higher Ticket Services Become More Affordable

Offering consumer financing for home services comes with a multitude of benefits that can significantly impact your business. Firstly, it allows you to increase your customer base by making your services more accessible. Many homeowners are unable to pay for expensive projects upfront, but with financing options, they can afford to hire your services.

More Sales

Consumer financing also helps to boost your sales volume. By offering flexible payment plans, you remove the financial barriers that may have prevented potential customers from choosing your services. This means higher conversion rates and increased revenue for your business.

Source: Shopify

Source: Shopify

Happy Customers

Furthermore, providing consumer financing can enhance customer satisfaction and loyalty. By giving customers the option to spread their payments over time, you improve their overall experience and make it easier for them to afford the services they need. Satisfied customers are more likely to become repeat customers and refer your business to others.

Competitive Edge

In addition to these benefits, offering consumer financing can give you a competitive edge in the home services industry. Many contractors and service providers do not offer financing options, so by providing this convenience to your customers, you differentiate yourself and stand out from the competition.

By offering consumer financing, you can expand your customer base, increase sales, improve customer satisfaction, and gain a competitive advantage in the market. It's a win-win situation for both your business and your customers.

Consumer Financing Options for Home Services

When it comes to consumer financing options for home services, there are several choices available. Understanding these options is crucial in determining which one best suits your business and your customers' needs. Let's explore the most common financing options for home services.

- Credit Cards: Accepting credit card payments is one of the simplest ways to offer consumer financing. Many homeowners already have credit cards with available credit, making it an accessible option for them. Partnering with a payment processor or setting up a merchant account allows you to accept credit card payments and offer financing plans.

- Installment Loans: Installment loans are another popular financing option for home services. With an installment loan, customers can borrow a specific amount and repay it over time with fixed monthly payments. Working with a lending institution or partnering with a loan provider allows you to offer installment loans to your customers.

- Deferred Payment Plans: Deferred payment plans allow customers to delay their payments for a certain period, usually with no interest or low-interest rates. This option can be attractive to homeowners who need immediate services but prefer to pay later. Setting up deferred payment plans requires working with a financing provider that specializes in this type of arrangement.

- In-House Financing: In-house financing involves providing loans directly to your customers without involving third-party lenders. This option gives you more control over the financing terms and allows you to tailor the payment plans to your customers' needs. However, it also requires careful financial management and risk assessment.

These are just a few examples of consumer financing options for home services. Each option has its own advantages and considerations, so it's essential to evaluate them based on your business requirements and your customers' preferences. The next step is to choose the right financing provider.

Learn more about GoSite and Wisetack Financing

Learn more about GoSite and Wisetack Financing

How to Set Up Consumer Financing for Your Home Service Business

Setting up consumer financing for your home service business involves a series of steps to ensure a smooth and effective implementation. Here's a step-by-step guide to help you navigate the process.

- Assess Your Business: Start by evaluating your business goals, financial capabilities, and target market. Determine if offering consumer financing aligns with your long-term objectives and if it's financially feasible for your business. Consider the demand for financing options in your industry and how it can impact your competitiveness.

- Research Financing Providers: Look for reputable financing providers that specialize in the home services industry. Consider factors such as interest rates, fees, repayment terms, and customer support. It's crucial to choose a provider that offers competitive rates, flexible terms, and excellent customer service.

- Evaluate Financing Programs: Review the financing programs offered by different providers and assess their suitability for your business. Consider factors such as minimum loan amounts, maximum loan terms, credit requirements, and approval processes. Choose programs that align with your customers' needs and preferences.

- Compare Costs: Compare the costs associated with each financing program, including interest rates, origination fees, and any other charges. Calculate the impact of these costs on your profitability and determine if they are reasonable for your customers. Remember that offering financing comes with costs, so it's important to strike a balance between affordability and profitability.

- Implement the Financing Program: Once you've chosen a financing provider and program, it's time to implement it into your business operations. This may involve integrating the provider's software or payment gateway into your website or point-of-sale system. Train your staff on how to explain and promote the financing options to customers.

- Promote the Financing Options: Actively market and promote your financing options to your target audience. Use various channels such as your website, social media, email marketing, and in-person interactions. Highlight the benefits of financing, such as affordability, flexibility, and convenience.

- Monitor and Optimize: Continuously monitor the performance of your financing program and make adjustments as needed. Track metrics such as conversion rates, average transaction value, and customer satisfaction. Analyze the data to identify areas for improvement and optimize your financing strategy.

Setting up consumer financing for your home service business may require careful planning and execution, but the benefits can be substantial. By following these steps, you can successfully implement consumer financing and unlock its potential for your business.

Key Considerations When Choosing a Consumer Financing Provider

Choosing the right consumer financing provider is crucial to the success of your financing program. Here are some key considerations to keep in mind when selecting a provider.

- Reputation and Experience: Look for a provider with a strong reputation and extensive experience in the consumer financing industry. Check their track record, customer reviews, and industry certifications. A reputable provider is more likely to offer reliable services and excellent customer support.

- Industry Expertise: Consider providers that specialize in the home services industry. These providers understand the unique challenges and requirements of your business and can tailor their services accordingly. They may also have partnerships with manufacturers or suppliers that can benefit your business.

- Range of Financing Options: Evaluate the range of financing options offered by the provider. Ensure they offer programs that align with your customers' needs and preferences. The more options available, the better you can cater to different customer segments and increase your chances of approval.

- Technology and Integration: Assess the provider's technology capabilities and integration options. Ensure their systems are compatible with your existing infrastructure, such as your website, point-of-sale system, or customer management software. Seamless integration allows for a smoother customer experience and efficient operations.

- Customer Support: Consider the level of customer support provided by the financing provider. Look for providers that offer dedicated account managers, responsive customer service, and training resources. Good customer support is essential for resolving any issues or concerns that may arise during the financing process.

- Cost and Fees: Compare the costs and fees associated with different financing providers. Consider factors such as interest rates, origination fees, processing fees, and any other charges. Choose a provider that offers competitive rates and transparent pricing.

- Approval Process: Evaluate the provider's approval process and credit requirements. Look for providers that offer quick and easy approvals, as this can improve the customer experience and increase conversion rates. However, ensure they have effective risk assessment measures in place to minimize defaults.

By considering these key factors, you can select a consumer financing provider that meets your business needs and provides a positive experience for your customers.

Steps to Promote Consumer Financing to Your Customers

Once you've set up consumer financing for your home service business, it's crucial to actively promote it to your customers. Here are some steps to help you effectively market your financing options.

- Educate Your Staff: Train your staff on the financing programs you offer and how to explain them to customers. They should be able to answer common questions, address concerns, and highlight the benefits of financing. Knowledgeable and confident staff can effectively promote financing options and increase customer interest.

- Update Your Marketing Materials: Update your website, brochures, flyers, and other marketing materials to include information about your financing options. Clearly communicate the benefits, such as low monthly payments, flexible terms, and quick approvals. Use compelling visuals and persuasive language to capture your customers' attention.

- Leverage Digital Marketing: Utilize digital marketing channels to reach a wider audience. Create targeted ads on social media platforms such as Facebook and Instagram. Use search engine optimization (SEO) techniques to improve your website's visibility in search engine results. Consider email marketing campaigns to engage with existing customers and promote financing options.

- Offer Special Promotions: Create special promotions or discounts for customers who choose to finance their home services. For example, you can offer a lower interest rate for a limited time or waive certain fees. These promotions can incentivize customers to consider financing and increase their likelihood of choosing your services.

- Highlight Success Stories: Share success stories or testimonials from satisfied customers who have used your financing options. These stories can provide social proof and build trust with potential customers. Consider featuring these stories on your website, social media, or in your marketing materials.

- Collaborate with Partners: Partner with other businesses or organizations in the home services industry to cross-promote your financing options. For example, you can collaborate with appliance stores, interior designers, or real estate agents. This can expand your reach and increase awareness of your financing offerings.

- Track and Analyze Results: Continuously monitor the performance of your marketing efforts and analyze the results. Track metrics such as website traffic, conversion rates, and customer inquiries related to financing. Use the data to identify areas for improvement and refine your marketing strategies.

By following these steps, you can effectively promote your consumer financing options and increase customer awareness and interest.

Common Challenges and How to Overcome Them

While offering consumer financing for home services can be beneficial, it's important to be aware of the common challenges that may arise and how to overcome them. Here are some challenges you may encounter and potential solutions:

- Credit Risk: Assessing the creditworthiness of your customers can be challenging, especially if you choose to offer in-house financing. Implement effective risk assessment processes, such as credit checks and income verification, to minimize the risk of defaults.

- Collection Issues: Collecting payments from customers can be a challenge, particularly if they miss payments or default on their loans. Establish clear payment terms and late payment policies from the beginning. Consider partnering with a collections agency to handle delinquent accounts, if necessary.

- Compliance and Legal Requirements: Consumer financing is subject to various laws and regulations, such as the Truth in Lending Act (TILA) and the Equal Credit Opportunity Act (ECOA). Ensure you comply with all applicable laws and regulations to avoid legal issues. Seek legal advice if needed.

- Customer Education: Some customers may be unfamiliar with consumer financing or have misconceptions about it. Educate your customers about the benefits and terms of financing options. Provide clear and transparent information to address any concerns or doubts they may have.

- Competitive Landscape: The home services industry is competitive, and other businesses may also offer financing options. Differentiate yourself by offering unique financing programs, exceptional customer service, and additional value-added services.

By proactively addressing these challenges and implementing effective strategies, you can minimize their impact on your business and ensure a successful consumer financing program.

Best Practices for Managing Consumer Financing Programs

Managing consumer financing programs requires careful planning, monitoring, and optimization. Here are some best practices to help you effectively manage your financing programs:

- Check and update regularly: Keep your financing programs up-to-date with your business goals and customer needs. Stay on top of industry trends and how people are using money.

- Track how well things are going: Keep an eye on important numbers like how many deals are approved, how much money is coming in, and how happy customers are. Use this info to figure out what's working and what's not.

- Make things easier: Simplify your financing processes so customers can get approved quickly and easily. Use technology to help, like online applications and automated systems.

- Teach your team the ropes: Train your staff to be experts in your financing programs. They should know how to answer customer questions and help them through the process.

- Excel at customer service: Build relationships with your customers by providing great service and staying in touch. Send them emails, reach out on social media, or start a loyalty program.

By following these tips, you can manage your financing programs like a champ. Keep adapting and improving your strategies to stay ahead of the game.

In Conclusion

Offering consumer financing options as a home services provider, whether as a contractor, plumber, electrician, or HVAC specialist, can significantly enhance your business success. It provides a beneficial solution for customers unable to afford immediate payments for expensive home projects, subsequently boosting your sales and customer satisfaction.

This guide equips you with a comprehensive understanding of consumer financing, covering its benefits, various types, choosing the right provider, and tips for successful implementation. With the correct strategies, you can attract more clients, increase sales, and set yourself apart from competitors, effectively taking your business to the next level.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)