When Clients Don't Pay: Tips for Small Business Owners

Don't let unpaid invoices hurt your small business. Read our tips for dealing with clients who don't pay on time. Take back control today!

Jump To...

The True Impact of Unpaid Invoices on Your Bottom Line | Is Invoice Factoring a Good Idea? | How to Handle Unpaid Invoices | 7 Tips for Avoiding Unpaid Invoices | Best Practices for Managing Unpaid Invoices | In Conclusion

As a small business owner, one of the most frustrating experiences is when a client doesn't pay for your products or services. Not only does it affect your cash flow, but it can also damage your relationship with the client.

In this blog, we will provide you with some tips on how to handle the situation when clients don't pay, including how to prevent it from happening in the first place, how to approach the client to request payment, and what legal options you have at your disposal. With these tips, you can effectively manage unpaid invoices while maintaining positive client relationships.

The True Impact of Unpaid Invoices on Your Bottom Line

When a business doesn't get paid for their work, it can cause big problems beyond just losing money. Here are some things to think about:

1. Cash flow: Not getting paid can make it hard for a business to pay bills, employees, and grow. This can lead to money problems and even make the business fail.

2. Time and resources: Trying to get paid can take up a lot of time and energy that could be spent on other things. This can make the business less productive and profitable.

3. Customer relationships: If a business doesn't get paid, it can make customers unhappy and hurt the business's reputation. This can cause customers to go somewhere else, which means the business loses money and opportunities.

4. Legal action: Sometimes, a business has to take legal action to get paid. This can be expensive and take a lot of time. It can also hurt the business's reputation, especially if it has to sue a customer it's worked with for a long time.

5. Creditworthiness: Not getting paid can make it hard for a business to get loans or other kinds of money in the future. This can make it hard for the business to grow or get through tough times.

To stop these things from happening, businesses should have clear rules for getting paid, ways to make sure people pay, and good communication with their customers.

Calculator to Help You Forecast Sales Increase By Reducing Late or No Payments

Have you ever wondered what would happen to your sales if you were able to reduce your accounts receivables by 50% or even 10%?

Using the formula below, simply add in your current total value of your accounts receivable (in dollar amount), then add a percentage that you’d like to reduce your AR by.

That number you get shows you how much more in sales you achieve by taking active steps to reduce late or no payments by your customers.

Is Invoice Factoring a Good Idea?

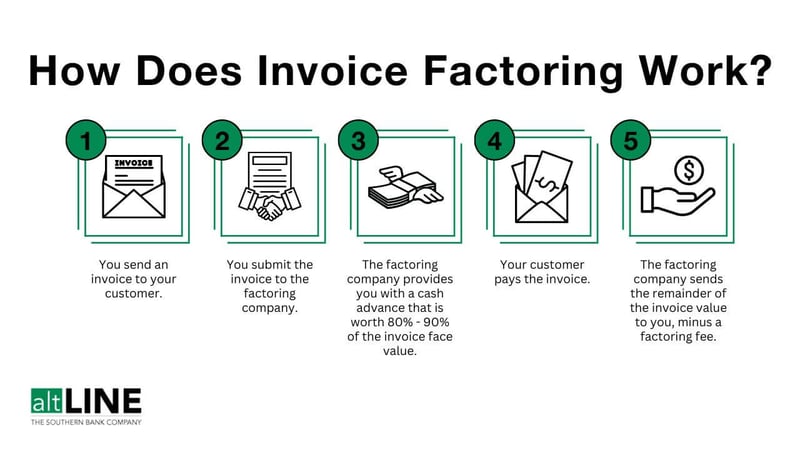

If you're a business owner who needs money fast, invoice factoring can help. You sell your unpaid invoices to a company for quick cash. Here are some pros and cons to consider:

Pros of Invoice Factoring

- Quick cash: You'll get money fast to pay bills, employees, buy things, or grow your business.

- No debt: Factoring isn't a loan, so you don't have to pay it back like you would with a loan.

- Easy to qualify: Factoring companies look at your customers' credit, not yours, so it's easier to qualify.

- No more collections: The factoring company will take care of collecting the unpaid invoices, which saves you time and work.

Source: altLine

Source: altLine

Cons of Invoice Factoring

- Less money: The factoring company will only pay you part of what's owed, so you'll get less money than you would have otherwise.

- Cost: The factoring company charges fees for their service, which can be different depending on some things.

- Bad for customers: Customers might not like getting calls from the factoring company to pay their bills. This could hurt your relationship with them.

- Dependence: If you use factoring too much, you might get stuck relying on it instead of making your own money and saving it.

Overall, invoice factoring can be good if you need money fast, but it's not a good long-term solution for your business. You should use it with other ways to make money and save it.

How to Handle Unpaid Invoices

If you’ve not been in business long or have only recently begun having an issue with customers not paying, the situation can be tricky. Here are tips for handling unpaid invoices professionally.

Remind the Customer of Unpaid and Late Invoices.

If a customer hasn't paid you yet, you need to keep asking them nicely for what they owe. This means you need to be patient, act professional, and keep good records.

Small business owners should make a plan for how often they'll ask for money owed, try different ways of asking, and maybe offer incentives to the customer. If the customer still doesn't pay, the business owner might need to take legal action. But before it reaches that point, regular reminders can go a long way.

Call the Customer.

It’s easy for customers to ignore or miss emails or messages. More importantly, the stress that unpaid invoices places on you and the customer can cause you to read into the silence.

So before you jump to conclusions or let your client get away, pick up the phone and make the call. Have an adult conversation with them where you can be direct and professional and get their immediate feedback.

Assume the Best of Your Customers Until You Know the Whole Story.

If someone owes you money, don't assume the worst just yet. Here are some tips to handle the situation in a positive way:

- Have a conversation: Ask them what's going on with the payment. Be polite and open, and give them a chance to explain.

- Listen carefully: Pay attention to what they say, ask questions to make sure you understand, and summarize their point of view.

- Think the best: Believe that the customer has a good reason for not paying, like maybe they misunderstood something or had money troubles for a little while.

- Find a solution: Work with the customer to figure out a way to get paid that works for both of you. Maybe they can pay in installments, or you can give them more time.

- Write it down: Keep track of every conversation and agreement you make with the customer. This helps you remember what was said, and proves it if there are any disagreements later on.

So long as you’re documenting the situation, this step gives you a huge advantage. More importantly, you increase your chances of keeping good customers should you find out that some customers simply didn’t get your invoice in the first place.

Offer Payment Plans

If a customer can't pay all at once, you might want to help them by making a payment plan. You should make clear rules for the payment, check how much money your customer has, make a plan both of you agree on, write it down, and keep track of the payments.

If you have to, you can even leverage legally-binding tools, such as signing a new contract or working with a third-party lender.

By doing this, you can manage unpaid bills without making your customer unhappy.

Send a Formal Letter in the Mail Outlining What is Owed, How Long It Has Been Unpaid, and Amassed Late Payment Penalties.

Formal letters are essential if there’s even a small chance that you have to take legal action with the customer who hasn’t yet paid you. If all your attempts above do not work, it’s time to send the customer a letter stating what they owe and what other penalties they face should they continue ignoring your attempts to collect payment.

Consult Your Attorney About Appropriate Legal Action.

Ideally, have your attorney draft and send the letter on your behalf. Getting them involved in your situation gives you more options to use the force of law if necessary.

Learn from the Situation, and Take Reasonable Steps to Avoid Them in the Future.

Of course it’s never okay that you do all the work and a customer won’t pay you.

However, don’t be afraid to notice ways in which your invoice process contributed to any unpaid invoices. They may be things you can do to improve your invoicing system and prevent these uncomfortable situations in the future.

7 Tips for Avoiding Unpaid Invoices

1. Create Clear Payment Terms and Add Them to Every Invoice.

Don’t ever assume that your customers “get it.” Put everything in clear terms on your invoices. As a business owner, you should include the following terms on your invoices:

- Payment due date: This is the date by which the customer must pay the invoice. It's important to make this date clear and easy to understand.

- Payment methods: Indicate the acceptable methods of payment, such as credit card, check, or electronic transfer.

- Late fees: Specify the amount of late fees that will be charged if the customer doesn't pay on time. This will encourage timely payments.

- Discounts: If you offer discounts for early payment or bulk orders, specify the terms of the discount on the invoice.

- Itemized list: Provide a detailed description of the goods or services provided, along with the quantity and price of each.

- Tax information: If applicable, include any sales tax or other taxes that must be paid.

- Contact information: Provide your business's contact information, including phone number, email address, and mailing address.

2. Set Up Multiple Invoice Reminders BEFORE Due Dates.

It’s common for business owners to send invoice reminders on a weekly basis until the invoice is paid. Whatever frequency you choose, the important thing is that your reminders are constant. Most customers simply forget to pay bills unless you remind them regularly. Source: GoSite

Source: GoSite

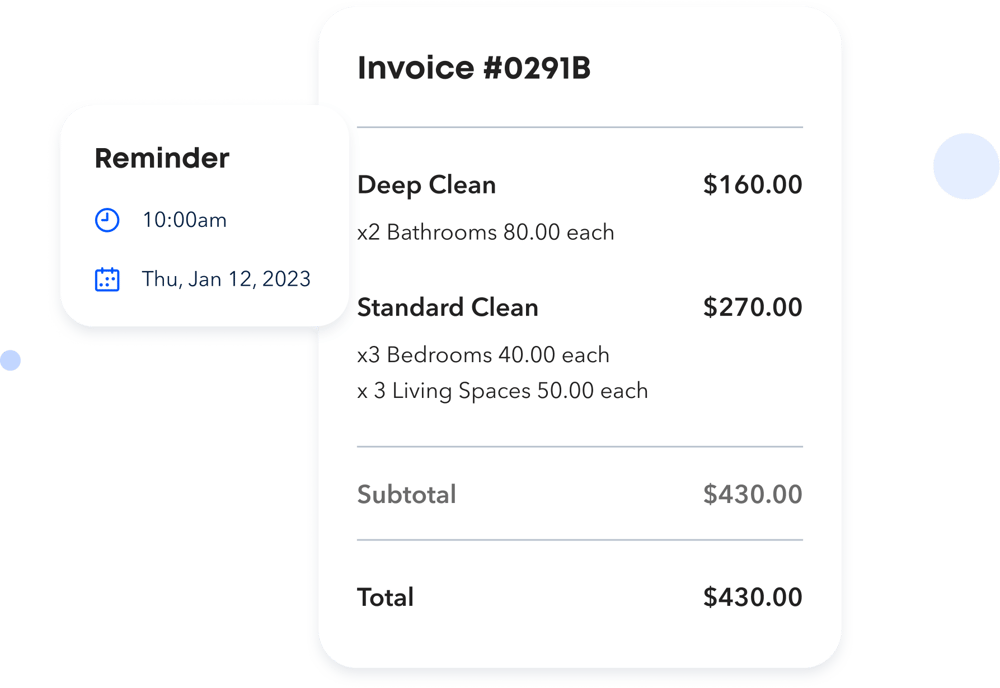

3. Don’t Wait or Forget - Send Your Invoices Out Immediately.

Sending out an invoice late is a sure-fire way to confuse your customers and risk not getting paid at all. Make it a point to send out an invoice as soon as you deliver your product or service as agreed.

4. Offer Contactless Payment Options So that Customers Can Pay From Their Mobile Devices.

The more secure options for payment you give customers, the greater the likelihood of you getting paid on time more often.

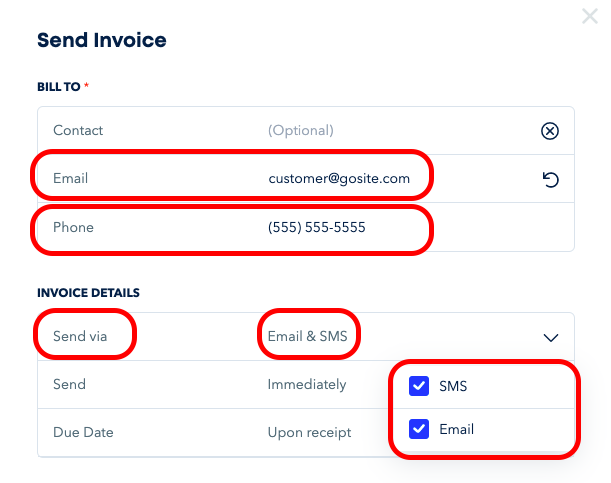

5. Send Mobile-Friendly Invoices Via Both Text and Email.

Email invoices are easy to miss, as they can get lost in overflowing inboxes or end up in spam folders. Texting your invoices (along with an email) is now commonplace and ensures that customers never miss them. Source: GoSite

Source: GoSite

6. For Higher-Ticket Services, Take a Deposit Upfront.

Many small business owners require customers to pay a deposit the moment they book a service. Especially if your work takes lots of time and money, an upfront deposit can establish a strong foundation where customers pay what is owed promptly.

7. Give Discounts for Early Payments in Full.

If you allow customers more than two weeks to pay or payment plans, then consider offering discounts for paying in full before the established due dates.

Best Practices for Managing Unpaid Invoices

Understand that It’s Perfectly Professional to Ask for Payment and to Expect Prompt Payment.

A lot of business owners are nervous about asking for money. No one wants to have a full-time job as a bill collector, but doing what it takes to get paid is an uncomfortable part of the job.

Remember, if you don’t get paid, you won’t stay in business. Recognize that a customer who refuses to pay is a liability you can’t afford.

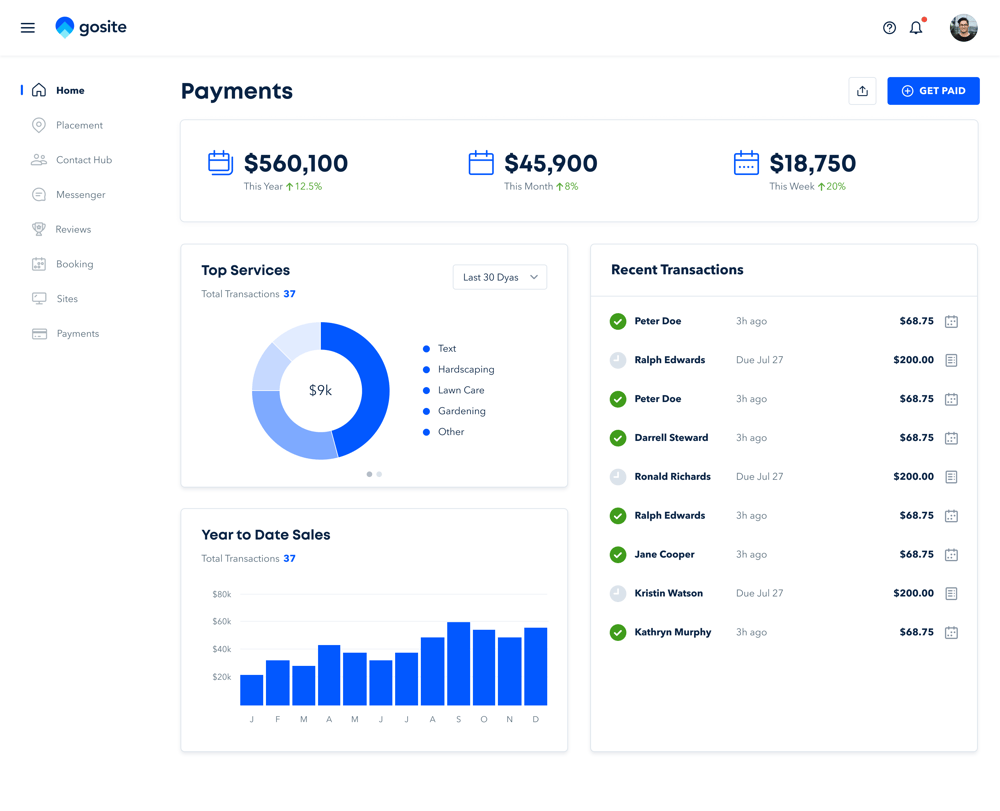

Invoice Software Makes Avoiding Unpaid Invoices Much Easier.

Most of the things we recommend in this blog - mobile-friendly invoicing, payment reminders, payment terms, etc. - are a piece of cake when you have the right invoicing software.

Source: GoSite

So consider investing in a tool that works for you and lowers the number of late payments you currently have to deal with.

Policies and Terms Mean Nothing If You Don’t Enforce Them.

While most clients are good people who have every intention of paying you, some will push the limits. So it’s imperative that your payment terms are non-negotiable, and you need to exert effort to enforce those terms.

Clear, Consistent Communication With Your Customers Goes a Long Way.

Don’t avoid interactions with your customers. Increase your people and communication skills by making it a point to connect with customers every chance you get.

This earns you the respect to get paid when you ask. Also, it helps you understand should a situation arise where a customer - who is normally a great customer - may not be able to pay right away as they intended.

Not only will this lower your late payments, but it will boost your reputation and increase your word-of-mouth business because people love working with you.

If You Get Into Dispute With a Customer, It’s More Important to Get Paid Than It is to Be Right.

As a small business owner, you want to have good relationships with your customers and avoid problems. But sometimes there are disagreements, especially about money. In those cases, it might be more important to get paid than to be right. Here's why:

- Legal action is expensive: If you have to go to court to solve a problem with a customer, it can cost a lot of money. You might have to pay for a lawyer, court fees, and other things. Even if you win the case, it might not be worth all the money you spent.

- Time is money: Sorting out a problem with a customer can take a lot of time. You might have to spend a lot of time gathering evidence, going to court, and talking to lawyers and mediators. This time could be better spent on other things that make your business grow.

- Reputation is important: If you have a fight with a customer, it could make people not want to do business with you, and you could lose money in the long run.

- You need money to keep going: For a small business to be successful, it needs to have enough money coming in. Even if you have to make a compromise, it might be worth it to get paid.

So, while it's important to be consistent in all your business dealings, sometimes it's better to get paid than to be right. By thinking about the costs and benefits of a dispute, and focusing on cash flow, small business owners can deal with problems and keep their business healthy.

Accurate Customer Records Help You Navigate Unpaid Invoices, Chargebacks, and Other Payment Disputes Effectively.

If you keep a strong paper trail (even an electronic one), it will be easy for you to recall what customers have told you, remind them of past agreements, and even offer evidence in support of a legal claim.

In Conclusion

When a customer doesn’t pay you, there could be a million reasons why. And it’s important that you maintain a strong posture to stand by your payment terms while also being flexible for customers who failed to pay due to misunderstandings or unforeseen circumstances.

Either way, these tips will give you what you need to lower your number of paid invoices and grow your business.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)