Avoiding Costly Mistakes: Tips for Preventing Invoice Discrepancies

Don't lose money or customers due to incorrect invoices! Learn tips for preventing invoice discrepancies and keeping your business running smoothly.

Jump To...

Importance of Accurate Invoicing for Home, Auto, and Professional Services | Common Invoice Issues | Tips to Prevent Invoice Discrepancies | Best Practices for Handling Invoice Disputes | Key Takeaways

Discrepancies in invoices can be a major headache for both the company and the customer. Paper invoicing errors cost companies $53.50 to fix on average. And with 80% of businesses still using paper invoices, it’s easy to see how these errors can add up. For small businesses especially, invoice discrepancies can be a major drain on resources and profits.

Importance of Accurate Invoicing for Home, Auto, and Professional Services

Invoice discrepancies are critical for home, auto, and professional service businesses for several reasons:

1. Invoice discrepancies can result in financial losses for the business. If the invoice amount is incorrect, the business may not receive the full payment it is owed, leading to a loss of revenue.

2. If customers receive an invoice with discrepancies, they may become dissatisfied with the service provided. This can result in negative reviews, loss of business, and damage to the business's reputation.

3. Invoice discrepancies can also lead to legal issues. For example, if an invoice includes incorrect pricing or other inaccurate information, it may violate consumer protection laws. This can result in legal action, fines, and further damage to the business's reputation.

4. If invoices contain discrepancies, it can create an administrative burden for the business. This may require additional time and resources to rectify the discrepancies and communicate with customers to resolve the issues.

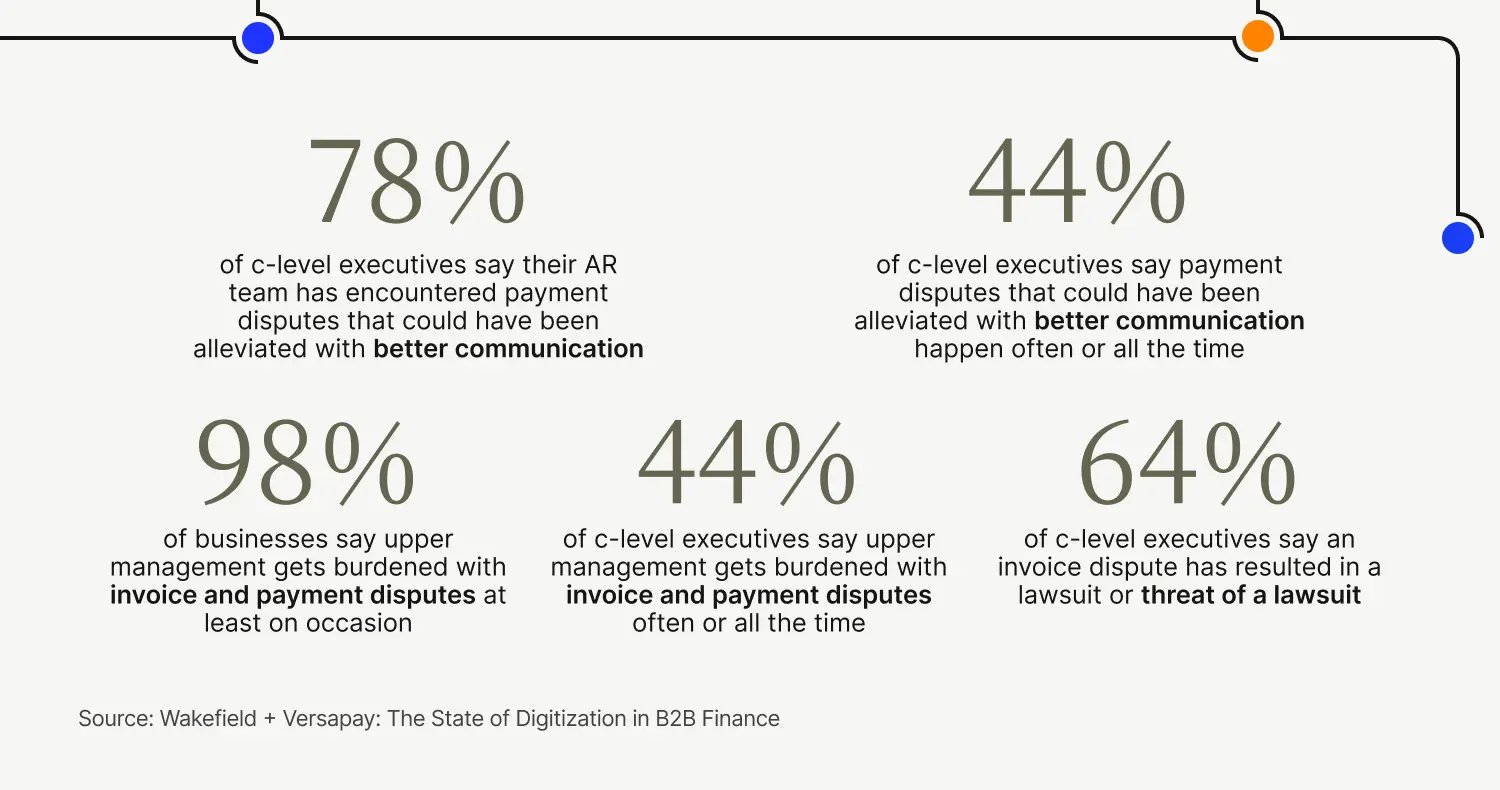

Source: Wakefield and Versapay

Source: Wakefield and Versapay

Causes of Invoice Discrepancies

The best way to avoid invoice discrepancies is to understand the root cause. That way, you can be proactive and take steps to avoid them from happening in the first place. Let’s take a look at some of the most common ones below:

Manual Errors

Entering data manually (whether digitally or on paper) can be time-consuming and error-prone, especially if you’re dealing with large volumes of invoices. Typos, misplaced decimal points, and incorrect calculations can all lead to serious mistakes that can be expensive to correct.

Miscommunication with Customers

When there’s a breakdown in communication between you and your customers, there’s a higher chance of errors and misunderstandings creeping into your invoicing process. For example, there might’ve been a lack of clarity around the scope of work or pricing leading to delays in receiving payment.

Invoicing Too Long After the Service Occurred

When too much time passes between when the service was completed and issuing an invoice, the details of the service might become fuzzy or forgotten completely. This can lead to confusion and potential disputes surrounding the agreed-upon prices and other crucial details.

The Importance of Addressing Invoice Discrepancies

Ignoring or putting off invoice discrepancies can result in a host of problems, and all of them result in big consequences for your business.

A healthy cash flow is essential for any business, particularly small businesses that may not have the financial reserves to cover large discrepancies. With 93% of companies experiencing late payments, invoice discrepancies put a strain on that cash flow and can even lead to cash-flow issues.

Beyond this, invoice discrepancies also affect customer relationships. 35% of businesses say their biggest challenge with collections is difficulty communicating with customers. When customers are overcharged — or don’t receive their invoice on time — it leads to customer dissatisfaction and can even lead to customers taking their business elsewhere.

Failing to address discrepancies can also take up administrative resources, something that can increase costs and decrease efficiency. And the primary reason new businesses fail? 38% say it’s because they run out of cash.

Common Invoice Issues

Invoicing is essential, yet it can also be a source of frustration. Whether it’s financial losses, damaged relationships, or delays, there are many common invoice issues that businesses encounter.

Incorrect or Not-Agreed-Upon Pricing

An incorrect invoice charge can happen due to a variety of reasons, like miscommunication, human error, or a lack of clear pricing agreements. If the customer receives an incorrect invoice charge, they might refuse to pay until the mistake is correct. Or in a worst-case scenario, they might demand a refund.

Incorrect Quantities or Hours

Incorrect quantities or hours are a particular issue for businesses that provide goods and services on an hourly or unit basis. Even a small error like this can result in undercharging or overcharging your customers.

Missing information

When customers request services, they might forget to provide important information like their full name, address, or phone number. This can make it challenging to invoice customers accurately, causing a back and forth that results in delays and potentially missing payments.

Late Invoicing

Late invoicing is most common among those that rely on paper-based invoicing systems. When invoices aren’t generated and sent out on time, it can confuse customers who might be unsure of what they owe or when payments are due.

Double Invoicing

A double invoice refers to two or more invoices generated for the same service or job. It might happen because of miscommunication between team members or entry errors.

Tips to Prevent Invoice Discrepancies

Pay Attention and Double Check Your Invoices Before Sending.

Double-checking your invoices may seem like an obvious tip, but many invoicing errors can be avoided by taking the time to review them. If you’re wondering how to double-check an invoice, you want to do everything to ensure invoice accuracy, including the customer name, billing address, and payment terms. Check the math to ensure all figures are correct and that the total amount due is accurate.

Use Invoicing Software.

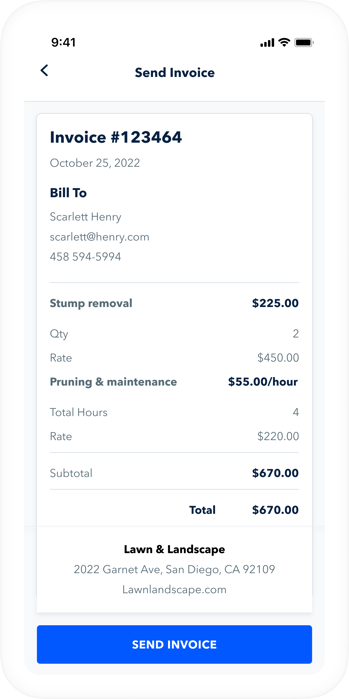

Invoicing software automates many of the invoice processes, reducing the likelihood of errors. It can help businesses stay organized by allowing them to create and track invoices from a centralized system.  Source: GoSite Invoices

Source: GoSite Invoices

This type of software prevents duplicate invoicing and works to record and track invoices properly. They also often include built-in checks and balances, such as automatic calculations and error detection, that can help identify and correct errors before they become discrepancies.

Set and Remind Customers of Clear Payment Terms.

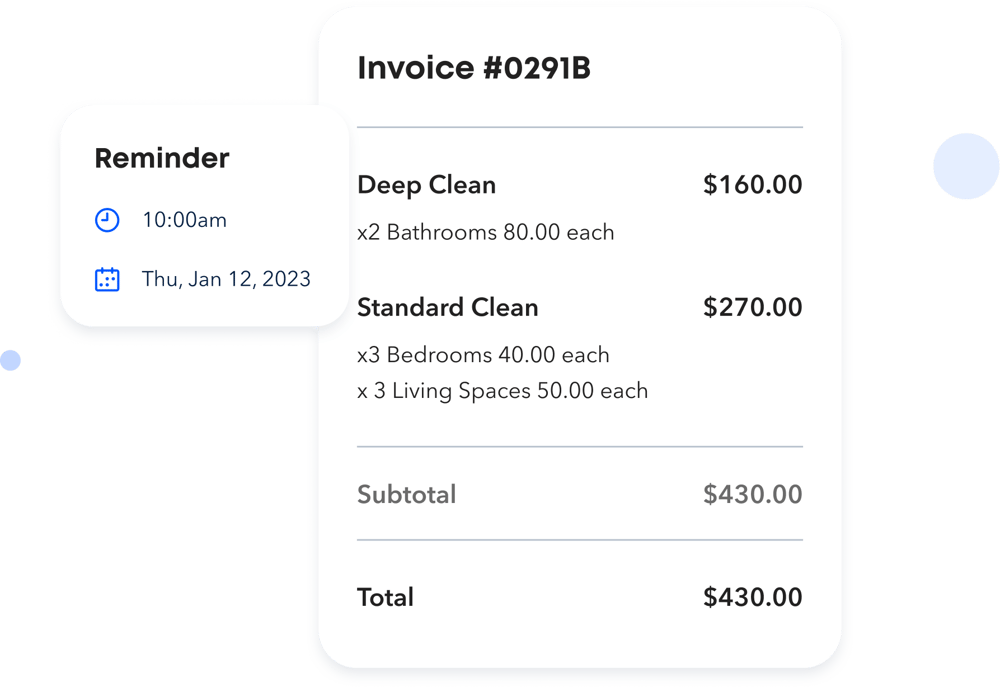

Businesses should clearly state their payment terms on every invoice and communicate them to customers before and after work is completed. Source: GoSite Invoices

Source: GoSite Invoices

You’ll also want to follow up with customers before payment is due to remind them of the upcoming deadline. You can do this via email, phone, text message, or even better - using software that automatically does it for you.

Text Your Invoices (instead of emailing them).

Text messages have a 98% open rate, whereas the average email open rate is 20.94%. Texting your invoices to your customers allows for instant delivery and confirmation of receipt. Email delivery, on the other hand, can be unreliable, as messages can end up in spam folders or get lost in a sea of emails. With text, you can also correct any mistakes right away and prevent conflict later on.

Practice Open Communication with Customers.

Source: Brodmin

Source: Brodmin

Customers should always feel comfortable coming to you with a problem. Make sure that your customers know who to contact if they have questions about an invoice or billing issue.

Open communication also means setting clear expectations upfront and keeping your customers in the loop throughout the invoicing process. Especially if there are any changes or updates to the invoice, you need to let your customers know right away.

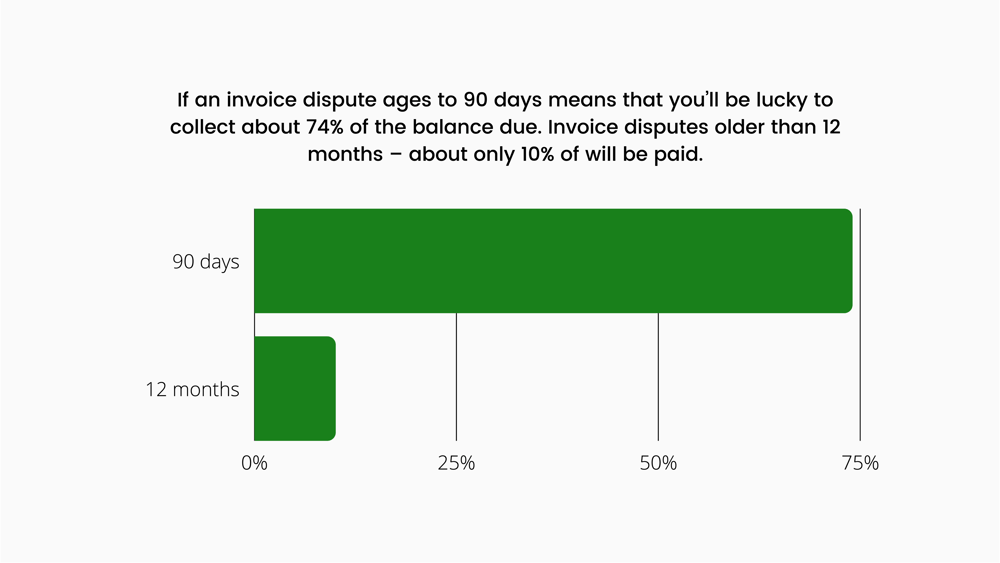

Studies show that if an invoice dispute lasts 90 days, you’ll be lucky to get 74% of the balance. After 12 months, only 10% of the balance will be paid.

Set Up and Enforce a Good Invoice Policy and Process

A good invoice policy should take into consideration all aspects of invoicing, such as the information included, how they should be submitted, and the payment timeline. Enforcing the policy also means communicating it to your accounting team, service team, and any contractors you work with.

Conduct regular audits of your invoice records, including payments received from customers, as well as payments made out by vendors or contractors who provide services or materials on your behalf (e.g., landscapers).

Have Customers Approve Estimates Before Starting the Work.

To have both parties on the same page, you should get customers to approve estimates before starting the work. Obtaining customer approval upfront can define the scope of the project, expected cost, and timeline..png?width=5760&height=4096&name=Estimates%20-%20Expired%20-%20Web%20(1).png) Source: GoSite Estimates

Source: GoSite Estimates

Businesses should provide detailed estimates that outline the work to be done, the materials required, and the cost of labor, for example. Once that’s provided, the customer should review and approve the estimate. This will build trust and transparency, putting your relationship with them on the right path.

The best way to do this is through an invoicing platform. That way, you can easily create and share estimates with customers for them to review, sign off on, and pay.

Best Practices for Handling Invoice Disputes

Despite your best efforts, invoicing disputes can still happen. These are some best practices for handling them.

Be Calm, Kind, and Professional.

Although handling disputes can be challenging and frustrating, it’s essential to maintain a professional demeanor throughout the process. Disputes can happen for various reasons, and it’s not necessarily a reflection of the quality of your work or the integrity of your business. And if there has been an error on your part, take responsibility and offer a reasonable solution to solve the issue.

Listen Actively, and Explain Your Side Clearly.

Handling disputes is often a delicate matter, so one best practice is to take the time to understand the other party’s perspective and ask questions to clarify any misunderstandings. When you’re explaining your side of the study, be sure to provide any documentation or evidence and be transparent about the invoice process you use.

Offer a Solution that is a Win-Win for Both Parties.

Rather than taking a confrontational approach, businesses should work with their customers to find a mutually beneficial solution to meet everyone’s needs. For example, businesses can offer a discount or partial refund for any disputed amount or provide additional services to compensate for any shortcomings. Showing a genuine willingness to resolve the issue will strengthen relationships with customers.

Use Collections and Legal Action ONLY as a Last Resort.

While collections and legal action may seem like a quick fix, they can also be expensive, time-consuming, and potentially damaging to your business. Instead, businesses should prioritize communication and negotiation when resolving disputes.

By opening up a dialogue with the customer, you might be able to identify the root cause of the dispute and find a mutually beneficial solution. If negotiation doesn’t work, businesses can escalate by involving a third-party mediator.

Key Takeaways

No matter what size your business is, invoicing discrepancies can pop up if you’re not paying attention or have a poor system in place. By understanding why these situations happen and following these best practices, you can avoid these mistakes and keep your accounting process running smoothly.

Some of the key takeaways to remember include ensuring accuracy and consistency in your data entry, establishing clear communication channels with customers, and implementing a double-check system for invoices before they are sent out.

It's always better to prevent problems than to fix them later, and the same goes for invoice issues. Addressing these issues proactively is what will keep your business running smoothly and efficiently. So don't wait for invoicing mistakes to pile up - take action now to avoid trouble down the line.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)