Customer Chargebacks - What They Are and How They Work

Customer chargebacks happen for a variety of reasons and they can take a heavy toll on small businesses. Read to find out how the chargeback process works.

As a business owner, you put your heart and soul into every transaction, hoping to give your customers an exceptional experience. But what happens when a customer disputes a charge and requests a chargeback?

Chargebacks can be frustrating, time-consuming, and costly, but they're also a reality of doing business. And it’s not even just time and money you need to consider; it’s the reputation of your business. 83% reported they would be less likely to buy from the brand again, while 50% of consumers would never buy again if they didn’t solve the issue within 30 days.

Jump To...

What Are Customer Chargebacks? | The Impact of Customer Chargebacks on Small Businesses | How To Dispute Chargebacks | Common Reasons Why Customer Chargebacks Occur | How Do Chargebacks and Refunds Differ? | Tips for Preventing Customer Chargebacks | Final Thoughts

What Are Customer Chargebacks?

At their core, customer chargebacks are a process that lets customers dispute charges on their credit card statements. Chargebacks can happen for various reasons, such as fraudulent activity or a customer not receiving the product or service they were promised.

Source: CreditDonkey

Source: CreditDonkey

The chargeback process is quite extensive. It’s much more complicated than just a simple dispute on a credit card statement and a customer either getting the money back or not.

But that doesn’t mean that you can’t take steps to prevent them, or even overturn them in cases where you followed through on your services to a petulant customer.

Can I Reverse a Chargeback?

You can’t “reverse” a chargeback per se. But what you can do is dispute it. And if you dispute a chargeback quickly (usually within 48 hours) and have the proper documentation, you will win the dispute and keep the money you made.

Understanding how the chargeback process works can help you with the dispute process.

How Do Customer Chargebacks Work?

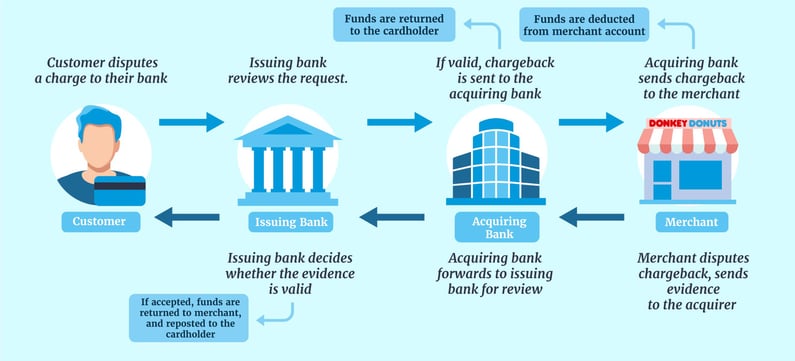

The chargeback process typically comprises six steps, from when the purchase is made to a potential arbitration process. Let’s take a closer look.

A Purchase Is Made

The actual customer purchase is the first stage of a potential chargeback. Once the charge shows up in their statement, they can issue a chargeback.

The Customer Disputes the Charge

When a customer disputes a charge on their credit card statement, they can request a chargeback with their bank or credit card company. They might cite a defective product or not receiving the goods or services they were promised. The bank will then investigate the claim and may request more information from the customer or the merchant to help them decide.

The Card-Issuing Bank Contacts the Merchant Bank

The customer's card issuer contacts the merchant bank to start the chargeback process. The merchant bank then contacts the merchant to let them know of the chargeback.

The Merchant Is Given an Opportunity To Refute the Chargeback

If the bank decides that the customer claim is valid, the funds from the disputed transaction are temporarily taken back from the merchant and given back to the customer. The merchant then has a chance to defend themselves by providing evidence to support their case, like receipts or delivery proof.

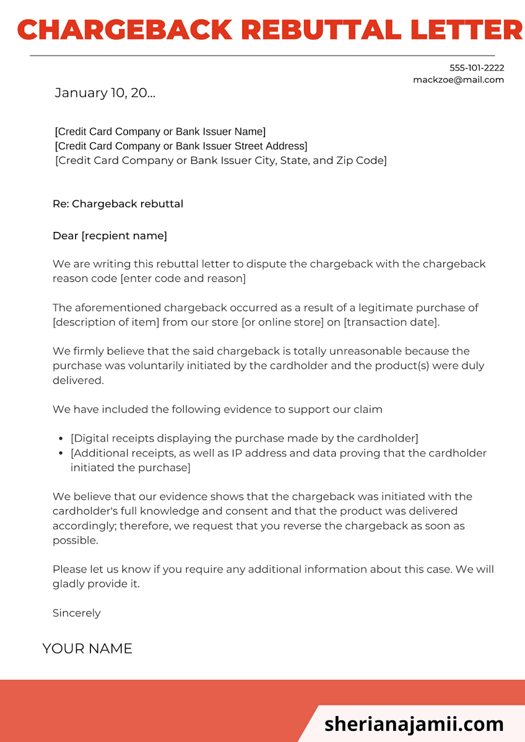

Source: Sheria Na Jamii

Source: Sheria Na Jamii

This may also include a chargeback rebuttal letter outlining the merchant's position and providing evidence to refute the customer's claims.

The Issuing Bank Reaches a Decision

The bank then has to review all the evidence and make that final decision again. If the chargeback is upheld, the money will be permanently returned to the customer, and the merchant may have to pay an extra fee. If the chargeback is not upheld, the funds will be returned to the merchant, and the customer will be charged for the transaction.

The Arbitration Process May Begin

If the chargeback is upheld, the merchant can choose to appeal the decision through an arbitration process. A third-party judge will review the evidence and make a final decision.

The Impact of Customer Chargebacks on Small Businesses

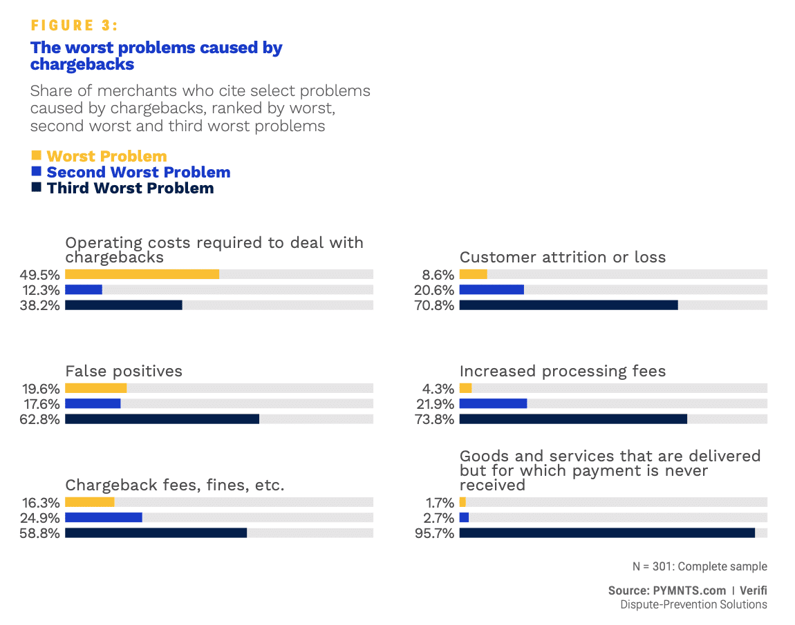

While chargebacks can happen to businesses of any size, they significantly impact smaller businesses, both financially and operationally. 49.5% of merchants cite operating costs required to deal with chargebacks as the biggest problem, as they can cause significant cash flow issues.

Source: PYMTS

Source: PYMTS

Other potential things that could hurt a business include false positives when legitimate transactions are mistakenly marked as fraudulent, fines, a loss of customer trust, and increased processing fees from banks and credit card companies if they are prone to chargebacks.

How To Dispute Chargebacks

If you’ve fallen victim to an unreasonable chargeback and are ready to start a dispute, here are a few tips to help you along the way.

- Gather evidence: Collect any documentation supporting your case, such as proof of delivery or customer communication.

- Craft a chargeback rebuttal letter: Write a clear and concise chargeback rebuttal letter that addresses the specific reasons for the chargeback.

- Respond promptly: Respond to the chargeback as soon as possible to avoid missing important deadlines.

- Work with your payment processor: Your payment processor may be able to guide you on how to best dispute the chargeback.

- Consider arbitration: If the chargeback is upheld and you believe you have a strong case, arbitration can help you challenge the decision.

Common Reasons Why Customer Chargebacks Occur

Understanding the situations that trigger customer chargebacks can enable your business to adopt a more proactive approach.

Credit Card Fraud

Criminals using stolen credit card information to make fraudulent purchases put businesses at risk of losing revenue and their reputation.

Customer Dissatisfaction

Those unhappy with a product or service often dispute charges, potentially harming a business's reputation and resulting in lost sales.

Billing Errors

Incorrect billing information, such as incorrect prices or double charges, can result in chargebacks and issues for customers and businesses.

Subscription Renewals

Customers often forget about their subscription renewals or might not want to continue subscribing, leading to chargebacks if they are charged automatically.

How Do Chargebacks and Refunds Differ?

Think of refunds as a friendly handshake, while chargebacks are more like a heated argument - both involve returning funds, just under different circumstances and motivations.

Refunds are initiated by the business and are a voluntary return of funds to the customer, typically due to dissatisfaction with a product or service. On the other hand, chargebacks are initiated by the customer and are a dispute of a transaction.

Tips for Preventing Customer Chargebacks

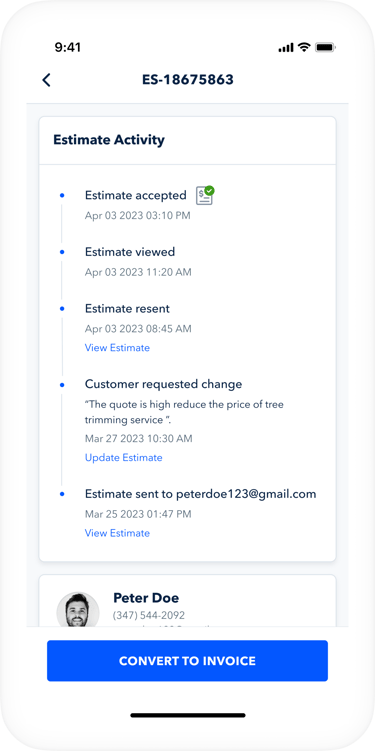

1. Build a Strong Estimate and Invoicing Process.

One of the best ways to prevent customer chargebacks is to build a strong estimate and invoicing process. This process should include obtaining customer approval before starting work, ensuring you always remember to invoice your customers, and using a digital tool to save time.

Source: GoSite App for Small Businesses

A digital tool can provide a clear and professional system for documenting customer approval, invoicing, and payments. You can easily create and send professional invoices, track payment due dates, and automatically send reminders for outstanding payments. This way, customers will be well aware of costs upfront, and there will be less disputes.

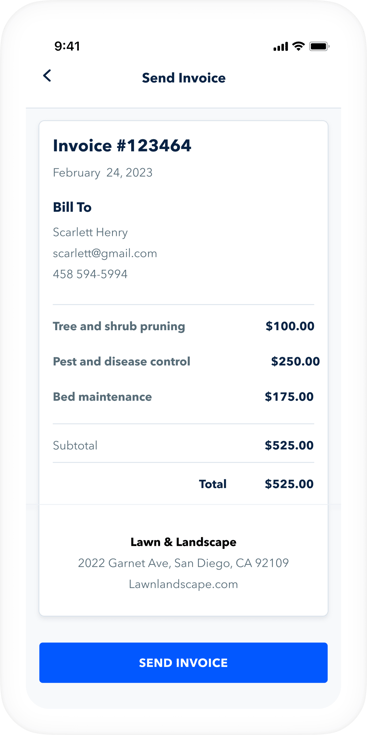

2. Add Details to Your Invoices.

Your invoices should include a detailed description of the products or services provided, the payment due date, and the payment amount. Including this information can reduce the possibility of confusion or disputes over the transaction.

Source: GoSite Invoicing

As well, have the date, customer billing information, and your company’s information clearly printed on the invoice to legitimize the document.

3. Use a CRM to Document Communication with Your Customers.

A customer relationship management (CRM) system is a remarkable, consolidated space for your business to digital document all estimates, invoices, payments, communications, and receipts. If, for some reason, you ever need to dispute a customer chargeback, you can quickly and easily access what you need.

4. Focus on Providing Great Customer Service.

Focusing on providing a positive customer experience reduces the likelihood of disputes and improves your reputation. Some ways to provide great customer service include responding quickly to customer inquiries, addressing customer concerns promptly and professionally, and following up with customers after a purchase.

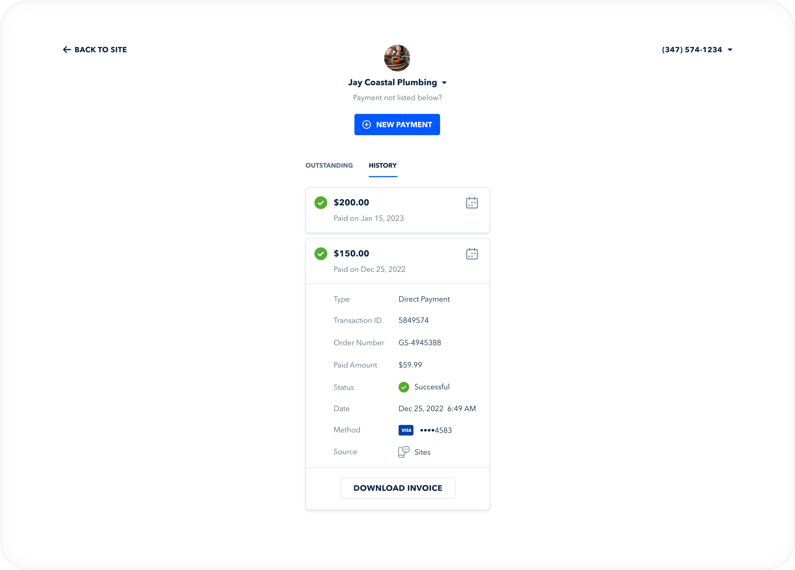

5. Always Give Customers Receipts.

Whether it’s a physical receipt or a digital one, receipts serve as a form of proof of purchase. Ensuring customers have a record of their transactions demonstrates professionalism and accountability, which can go a long way in building trust and loyalty.

Source: GoSite App for Small Businesses

Offering a digital receipt system can make it easier for customers to store records of their purchases and can also help you save time on manual paperwork.

6. Offer the Option for Customers to Pay Via Bank Transfer.

When customers pay via bank transfer, it eliminates the possibility of chargebacks altogether. Bank transfers are not only immune to chargebacks but are typically more secure than credit card payments, which can reduce the risk of fraud or disputes. This payment method might even be less expensive for businesses, thus, reducing the cost of processing payments.

Final Thoughts

As a business owner, the last thing you want is to deal with customer chargebacks - the process is lengthy, and certainly isn’t fun. But worries aside, by implementing these tips and best practices, you can reduce the likelihood of chargebacks and protect your bottom line.

From providing excellent customer service to documenting all communications with customers, there’s a lot you can do to safeguard your business. Like with many things, prevention is key, so be sure to take a proactive approach involving digital tools, secure payment options, and a vigilant attitude. Don’t let chargebacks get in the way of your thriving, successful business.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)