Contactless Payments: A Small Business’s Complete Guide

Upgrade your small business with safe and easy contactless payments. Our complete guide has everything you need to know.

Jump To...

What are Contactless Payments? | The Most Common Types of Contactless Payments | 5 Key Benefits of Contactless Payments for Small Businesses | What are Security Concerns for Contactless Payments? | Other Ways to Incorporate Contactless Payments Into Your Business | GoSite + Stripe - Contactless Payments for Local Business Owners | Key Takeaways

Studies have shown that 79% of consumers worldwide are now using contactless payments, and that number is rising. This new way of payment isn’t just tons more convenient, it also offers sleek and reliable security that other payment options don’t.

But contactless payments are just for the “big dogs.” Small businesses are one of the fastest-growing adopters of contactless payments, since they help increase sales, improve customer satisfaction, and enhance overall efficiency.

What are Contactless Payments?

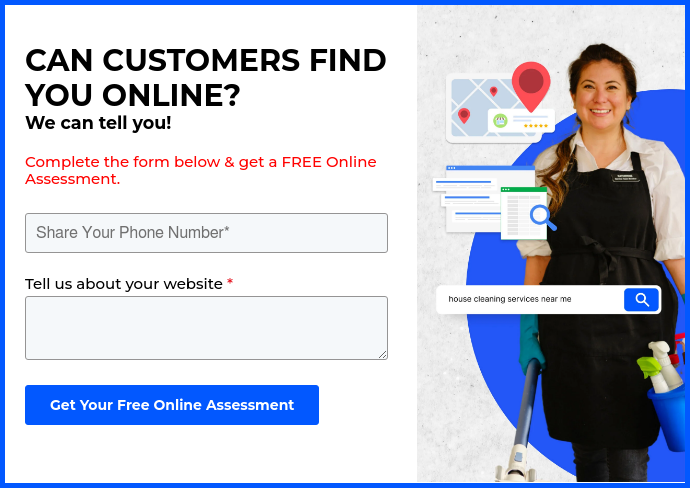

Source: The Tennessee Credit Union

Contactless payments are a fast and secure way to make payments without the need for physical contact with a payment terminal.

These payment methods use technologies like Near Field Communication (NFC) and radio frequency identification (RFID) to enable communication between the payment device (such as a smartphone or card chip) and the terminal (business device taking payment).

Customers make payment by tapping or waving the device near the terminal, and the transaction processes instantly.

Contactless payments are also known as “tap-and-go” or “touchless payment” transactions.

What Contactless Payments are NOT

Contactless payments are not the same as mobile payments, such as your typical cash app like PayPal or Venmo. These cash apps (commonly known as peer-to-peer apps) move money among friends from one holding account to another and may integrate with contactless payments.

Mobile payments usually require the use of a specific mobile app and often require a PIN, password, or biometric identification for security purposes.

Contactless payments, on the other hand, are initiated using a contactless payment card, mobile device, or wearable and require no physical contact with the payment terminal.

How They Work

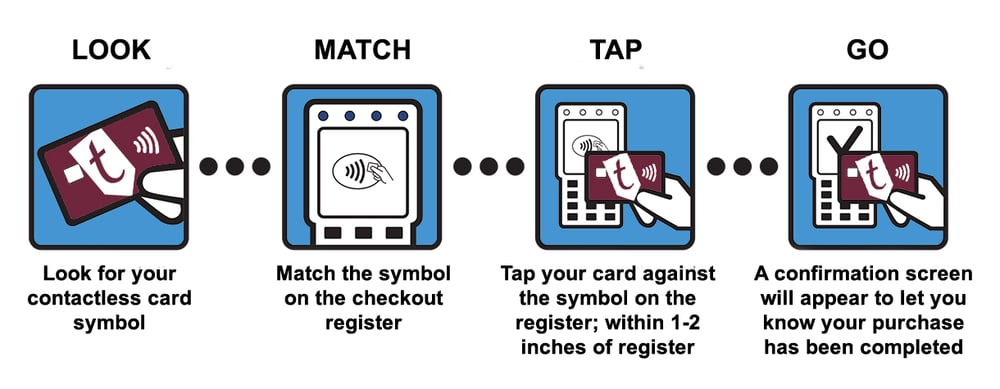

So, how does contactless payment work? Here’s a quick breakdown.

NPS Technology

Near-field communication is a short-range wireless technology that enables communication between two devices in close proximity, such as a contactless card and a payment terminal.

When a customer taps their contactless card on a payment terminal, the NFC chip in the card sends a signal to the terminal, initiating the payment transaction.

This process is fast and secure, with the transaction taking only a few seconds to complete.

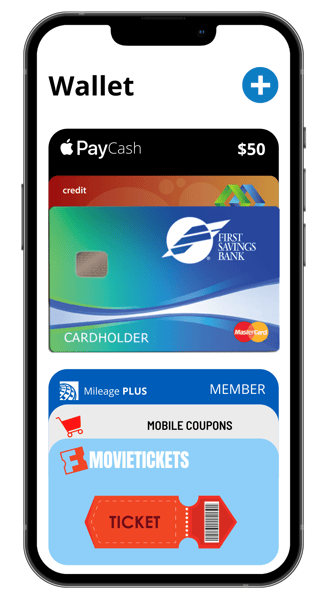

Mobile Wallets

Mobile wallets are digital wallets that allow customers to store and manage their payment information on their mobile devices, making it easy to make purchases without needing to carry a physical wallet or card.  Source: Apple and First Savings Bank

Source: Apple and First Savings Bank

These mobile wallets use NFC contactless technology to communicate with payment terminals, allowing customers to make contactless payments by holding their mobile devices near the terminal.

The Most Common Types of Contactless Payments

There are several types of contactless payments that small businesses can use to enhance their payment systems.

Each payment method has its own advantages and features, making it essential for businesses to choose the right payment method that aligns with their business objectives and customer needs.

Remote Payments (Credit Card, Debit Card, Bank Transfer)

Remote payments are the most commonly used type of contactless payment. They involve using a credit or debit card or bank transfer to make a payment. This payment method is widely accepted and used, making it easy for businesses to incorporate it into their contactless payment systems.

Customers can make payments by simply tapping their card or using their mobile banking app to transfer funds to the merchant's account. Remote payments provide a fast and secure way to process transactions without the need for physical contact.

Mobile Pay (Apple Pay, Google Pay, Samsung Pay)

Mobile pay has really started to take off over the past few years; it’s a payment method that allows customers to pay using a mobile wallet on their smartphones.

Apple Pay, Google Pay, and Samsung Pay are the most widely used mobile payment platforms. Customers can add their credit or debit card information to their mobile wallet app, and then use their smartphone to make a payment.

Mobile pay uses Near Field Communication (NFC) technology to communicate with the merchant's payment terminal, enabling a contactless transaction. It is highly secure, as payments require authentication via biometric data such as fingerprints or facial recognition.

Pay Via QR Code

QR code payment is another contactless payment method that has become popular in recent years. Customers can scan a QR code using their smartphone camera, which directs them to a payment portal where they can complete their transactions.

This payment method is highly convenient, as it eliminates the need for a physical payment terminal. QR code payments can be used for in-store purchases, as well as for online payments and bill payments.

Payment Links

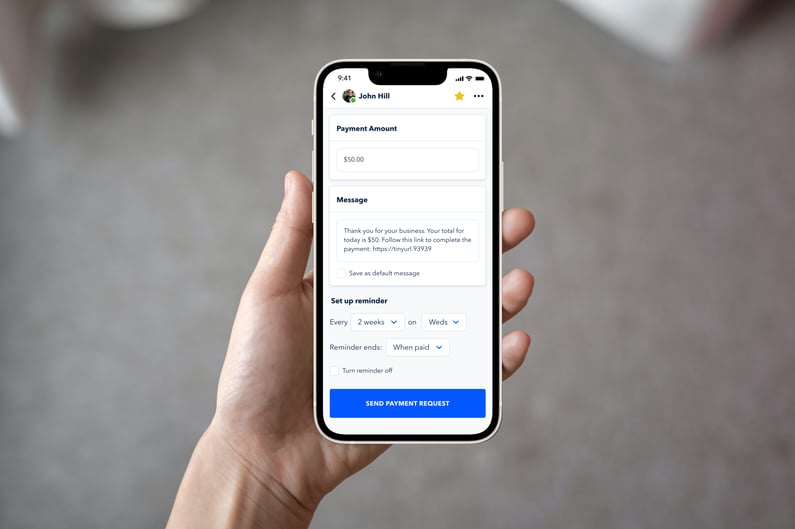

Payment links are a convenient way for businesses to request payments from their customers.

Source: GoSite Payments

Source: GoSite Payments

Merchants can send payment links to their customers via email or messaging apps, which direct them to a payment portal where they can complete the transaction.

This payment method is ideal for businesses that operate remotely or have a mobile workforce. Payment links allow businesses to streamline their payment processes and reduce the need for manual invoicing and payment tracking.

5 Key Benefits of Contactless Payments for Small Businesses

1. You Get Paid Faster.

Contactless payments eliminate the need for customers to write checks or fumble with cash, speeding up the payment process. With traditional payment methods, such as checks or cash, there are often delays and processing times that can slow down the payment process.

This can be particularly frustrating for small businesses that need cash flow to keep their operations running smoothly.

With contactless payments, you can receive your payment almost instantly and avoid the wait times that come with traditional payment methods. Plus, you won’t have to spend time depositing checks or making trips to the bank.

2. It’s Super Convenient for Your Customers.

As the world gets faster and faster, convenience is becoming more of a priority for customers.

Contactless payments allow customers to save time in the store and make the entire sales process seamless. Customers can simply tap their contactless payment card or phone and go without having to fumble with cash or wait in line to use a payment terminal.

With mobile wallets and other digital payment methods, customers can easily make purchases from the comfort of their own homes as well, without having to enter their payment information each time.

3. You Don’t Have to Worry About the Risks and Hassle of Handling Cash.

Handling cash can be risky, especially if you’re dealing with large amounts of money. Contactless payments eliminate the need for cash, which means you don’t have to worry about theft or the hassle of counting and storing physical currency.

Contactless payments will also reduce the amount of time you spend reconciling your books and handling cash flow.

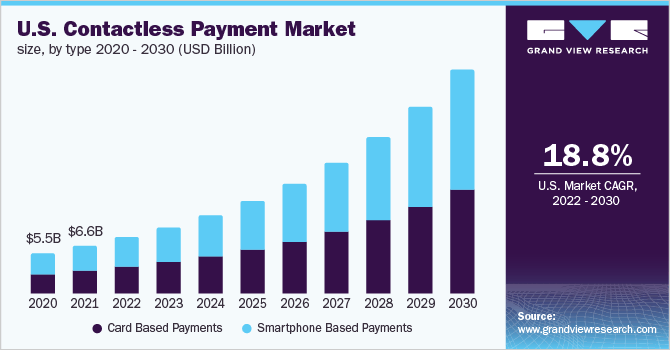

Source: Grand View Research

Source: Grand View Research

4. There’s Less Chance of Fraud.

Contactless payments use advanced security features such as encryption, tokenization, and biometric authentication, making them less vulnerable to fraud.

Since there’s no need for customers to enter their PINs, contactless payments can help prevent skimming and other types of payment fraud.

5. You’ll Get More Sales.

Offering contactless payment options can increase your sales, especially if your customers prefer to use credit or debit cards. In fact, studies have shown that businesses that offer contactless payments can see an increase in transaction volume and overall revenue.

By offering multiple payment options, you’ll also attract more customers who prefer the convenience and security of contactless payments.

What are Security Concerns for Contactless Payments?

As with any payment method, security is a major concern for businesses and customers alike. No matter what payment method you use, there is always some level of risk.

However, contactless payments have been shown to be more secure than traditional payment methods like cash or checks.

This is because contactless payments utilize technologies like encryption and tokenization to protect sensitive data, making it harder for cybercriminals to intercept and steal information. Many contactless payment providers also offer fraud protection measures like real-time monitoring and alerts to quickly detect and address any suspicious activity.

There are a few security concerns to be aware of with contactless payments.

There Isn’t Always Enough Authentication.

In some cases, contactless payments only require the card or device to be near the payment terminal to complete the transaction without any additional verification, such as a PIN or signature.

This could potentially lead to fraudulent transactions if the card or device is stolen; there would be no barrier remaining between the thief and your funds.

Unauthorized Payments Could Occur.

Unauthorized payments can also occur with contactless payments.

For example, if someone were to steal a customer's contactless card or device, they could make purchases without the owner's consent.

In addition, contactless payments made via mobile devices may be susceptible to hacking or phishing attacks, which can compromise the user's sensitive information and lead to unauthorized payments.

There Still Might Be Fraud Risks.

Even with the security measures put in place for contactless payments, there is still a risk of fraud.

Criminals have found ways to intercept the communication between the payment device and the payment terminal, allowing them to steal data and conduct fraudulent transactions.

Some Consumers and Vendors are Concerned About Data Privacy.

Some consumers and vendors are also concerned about data privacy when it comes to contactless payments.

In a contactless payment system, the payment information is transmitted wirelessly and stored in the cloud, making it susceptible to hacking and other forms of cyber-attacks.

Contactless payments may also require customers to share more personal data than they would with traditional payment methods, such as credit cards.

Some contactless payment methods may require the use of mobile wallets, which can store a wealth of personal information such as credit card numbers, bank account details, and even biometric data.

Contactless Payment Best Practices for Small Businesses

1. Avoid Using Cash Apps. Choose Contactless Payment Options that are Suitable for Business Transactions.

While cash apps like Venmo or CashApp may be convenient for personal transactions, they may not be the best option for business transactions.

These apps are not designed for businesses and may not offer the same level of security and protection as other contactless payment options that are specifically designed for businesses.

Instead, choose contactless payment options that are specifically designed for small businesses.

2. Publicly Display All the Payment Options You Offer.

Make sure to prominently display all the payment options that your business offers. This includes displaying all of the contactless payment options as well as traditional payment methods you accept in your store, on your website, and on all of your marketing material.

Source: MySafetySign

Source: MySafetySign

This will make it easier for your customers to know which payment methods you accept, and make it easy for them to pay in a convenient way.

3. As with Any Payment Method, Keep an Eye Out for Fraud.

Contactless payments are generally secure, but as with any payment method, there is always a risk of fraud.

Be sure to take the necessary steps to protect your business from fraudulent transactions.

This may include setting up fraud alerts, using secure payment processing systems, and training your staff to identify and prevent fraudulent transactions.

4. Encourage and Educate Your Customers on How to Use Contactless Payments.

It is important to educate your customers on how to use contactless payments, especially those who may not be familiar with the technology.

Displaying clear instructions or providing assistance during the transaction process can help customers feel more confident using contactless payments.

You can also encourage customers to use contactless payments by highlighting the benefits such as speed, convenience, and safety.

5. Train Your Crews and Staff on Contactless Payments.

It is crucial to train your employees on how to accept contactless payments and how to troubleshoot any issues that may arise during the transaction process. This ensures that the payment process runs smoothly and efficiently for both your business and your customer.

Employees should also be aware of the security risks associated with contactless payments and should take appropriate measures to prevent fraud and data breaches.

6. Make Sure You’re Using the Proper Payment Platform and Hardware.

Using the right payment platform and hardware is important to ensure that your business can accept contactless payments securely and efficiently.

Make sure your payment platform is reliable and supports the type of contactless payments you want to accept.

Also, ensure that your hardware is compatible with your payment platform and has the necessary security features to protect customer data.

Other Ways to Incorporate Contactless Payments Into Your Business

As contactless payments continue to become more prevalent, it's important for small businesses to keep up with the trend and incorporate these payment methods into their operations.

There are some creative ways to integrate these payment options into your business that you may not have considered yet. By embracing these additional methods, you can streamline your payment process even more and provide added convenience to your customers.

Add Payment Links to Mobile Invoices.

This method saves time and reduces the need for manual invoicing and payment tracking. It takes away the hassle of waiting for checks to arrive in the mail or for customers to physically come into the store to make a payment.

Source: GoSite Payments

Source: GoSite Payments

Payment links can be sent via email or text message, and customers can simply click on the link and follow the prompts to make their payment. This allows them to make payments at their convenience, increasing the likelihood of timely payments and improved cash flow for your business.

Additionally, payment links can be customized to include payment options such as credit card, debit card, or bank transfer, making it more convenient for customers to pay with their preferred method.

For High-Ticket Services, Take a Contactless Payment as a Deposit At the Time You Book an Appointment.

Taking a deposit in the form of a contactless payment is a great way to secure the customer's commitment and avoid losses for high-ticket services. By taking a deposit, you can guarantee that the customer is serious about the appointment and reduce the risk of no-shows or last-minute cancellations, which can be especially costly for small businesses.

Additionally, taking a deposit using a contactless payment method is convenient and saves time for both you and the customer. The payment can be processed instantly, without the need for physical contact, making the process seamless and efficient.

Offer Online Payments on Your Website.

In addition to improving the overall shopping experience for customers, offering online payments on your website can also help you reach a wider audience. With an online payment system, customers from anywhere in the world can purchase your products or services, increasing your potential customer base.

Payments on your website reduce the need for manual processing of transactions, which can save time and resources for small businesses. With automated payment processing, you can focus on other aspects of your business, such as marketing and customer service, while still ensuring timely and accurate payments.

Consider Using Contactless Payments to Offer Service Subscriptions.

If your small business offers a subscription-based service, contactless payments can streamline the process for both you and your customers.

By allowing customers to set up recurring payments through a mobile wallet or payment link, you can avoid the hassle of sending invoices or collecting payments each month. This not only saves time, but it also ensures that you get paid on time, every time.

On top of this, offering a subscription service can encourage customer loyalty and lead to more predictable revenue for your business.

Use Contactless Payments to Award Gift Cards for Customer Loyalty and Referrals.

Another way to incorporate contactless payments into your small business is by offering gift cards that can be purchased and redeemed through mobile wallets or payment links.

This can be a great way to reward loyal customers and encourage referrals, while also simplifying the gift card process. By offering contactless gift cards, you can eliminate the need for physical cards or vouchers, and make it easy for customers to purchase and use gift cards online or in person.

Plus, with the added convenience of mobile payments, customers are more likely to redeem their gift cards and make additional purchases, driving more revenue for your business.

GoSite + Stripe - Contactless Payments for Local Business Owners

If you're a local business owner looking to implement contactless payments, GoSite + Stripe could be the solution for you.

GoSite Payments is a game-changer for small business owners looking to streamline their payment processes. According to recent statistics, businesses that use our GoSite Payments feature experience a 50% reduction in late payments, a 30-50% increase in scheduled service appointments, and a 150% boost in sales.

With GoSite Payments, you can set up your account instantly and start using it right away. A link to a customer’s email, phone, or instant messenger allows you to receive payments without having to spend weeks figuring out how the software works. This way, you can focus on what you do best without having to chase late payments or deal with customer collections.

Our partnership with Stripe, a leading online payment platform, allows local business owners to get started accepting contactless payments directly from their website, invoices, or in person right away.

This partnership enables business owners to accept payments with ease, streamlining their payment processing and providing a seamless payment experience for their customers.

With GoSite, you can take the stress out of bookkeeping and collections, create, send, and track all of your invoices and payment requests online in one place, and offer secure payment links for faster payments.

Key Takeaways

As payment structures continue to evolve, contactless payments are starting to take over.

This shift towards contactless payments is due to the safety and convenience they offer, making them a valuable tool for small businesses looking to improve their payment processing, offer convenient payment options to their customers, and stay competitive in the market.

By following best practices and using the right payment processing tools, small businesses can easily adopt contactless payments and reap the benefits of this innovative payment method.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)