Best Small Business Loans for Home Services

Small businesses sometimes need the assistance of a loan. In this article, we discuss the best small business loans for home service companies.

Jump To...

What Are Small Business Loans? | Why Some Home Services are Great Candidates for Small Business Funding | Understanding SBA Loans | How To Choose the Best Loan for Your Home Service Business | The Best Lenders for Home Service Owners | Best Business Credit Card Lenders | In Conclusion

As a home service entrepreneur, you might find yourself seeking financial aid to scale your business, acquire essential equipment, or bring more skilled hands on board. Obtaining a small business loan can help you take your business to the next level.

In this article, we will cover everything you need to know about small business loans for home service companies.

What Are Small Business Loans?

A small business loan is any loan that allows you to borrow and invest in your small to medium-sized business and typically reports to your business’s (rather than your personal) credit.

These loans help businesses grow by providing them with the necessary capital for various purposes, such as purchasing equipment, expanding operations, or meeting short-term cash flow needs.

Lenders, including banks, credit unions, and online lenders, offer a wide range of small business loan options to suit the unique requirements of different businesses.

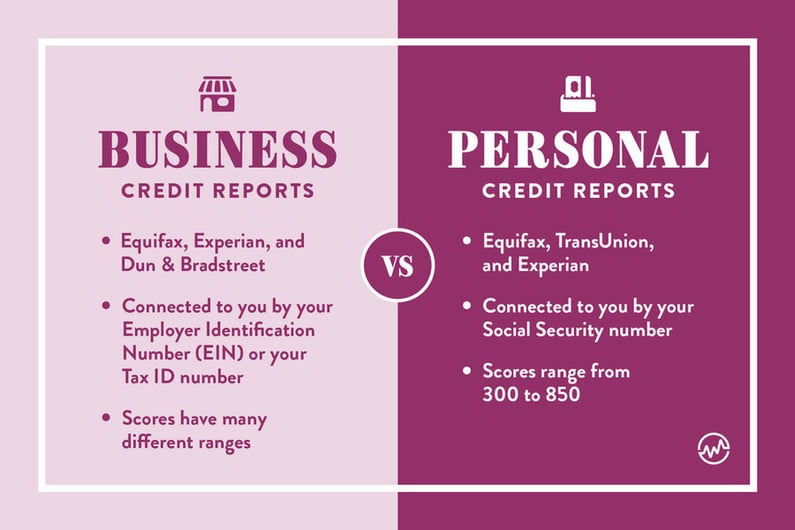

What’s the Difference Between Personal Credit and Business Credit?

Personal credit and business credit are two separate financial profiles that affect an individual's and a company's ability to obtain loans, respectively. Understanding the differences between them is essential for small business owners seeking financing.

Personal credit is a reflection of an individual's creditworthiness based on their financial history, including credit card usage, loan repayment, and overall debt. Credit bureaus compile this information to generate a personal credit score, typically ranging from 300 to 850.

Business credit, on the other hand, is a measure of a company's creditworthiness. It is based on various factors such as payment history to suppliers, lenders, and other creditors, as well as the company's financial stability and overall credit utilization.  Source: Ashley Gunther on LinkedIn

Source: Ashley Gunther on LinkedIn

When a business is new, lenders often place more emphasis on the owner's personal credit score. However, as a business grows and develops its credit profile, the importance of its business credit score increases.

This is why it’s so important for a business to have positive cash flow history in order to secure the best funding solutions. Using tools like GoSite that help businesses reduce late payments and get paid faster helps tremendously with this.

When is It Okay to Get Personal Loans to Launch or Grow Your Business?

Business loans are great because they don’t report to your personal credit, allowing you more freedom to get car loans, home mortgages, or personal credit cards.

But the reality is that you may not have any business credit to leverage, especially if you’ve been in business for less than two years. If you’re a brand new business and you need funding fast, personal loans may be your only option.

And if you find yourself in the position of only being able to get personal loans, protect your personal assets by only using unsecured loans. (More on this later.)

Why Some Home Services are Great Candidates for Small Business Funding

The home services industry has shown tremendous growth potential in recent years, making it an attractive industry for small business lenders. There are several reasons why home service businesses are considered excellent candidates for financing.

Many Home Services are Essential Regardless of the State of the Economy.

Home services such as plumbing, electrical work, heating, and cooling are essential for maintaining a comfortable and functional living environment. As a result, the demand for these services remains stable even during economic downturns.

This stability makes home service businesses more likely to continue generating revenue and maintaining profitability, which in turn makes them attractive to lenders and investors.

Many Home Services and Contractor Businesses Process High-Ticket Receipts.

Home service businesses often deal with high-ticket transactions, as projects such as home renovations, installations, and repairs can be quite expensive. This steady stream of high-value receipts provides a reliable source of revenue, which demonstrates financial stability to lenders.

The high-ticket nature of these transactions requires the business to be on top of their invoices, but also typically leads to larger profit margins, making it more likely for the business to succeed and grow over time.

There is a Huge Shortage of Skilled Trades Entrepreneurs.

According to the U.S. Bureau of Labor Statistics, there will be an estimated 3 million unfilled skilled trades jobs by 2028. This presents a unique opportunity for ambitious entrepreneurs looking to fill this gap and capitalize on the growing demand for skilled trades services.

As a result of the shortage, lenders may be more willing to extend funding to these types of companies, knowing that there is a strong demand for their services and a potential for sustained growth in the industry.

Understanding SBA Loans

The Small Business Administration (SBA) is a government agency that supports the growth and development of small businesses in the United States.

One of the primary ways the SBA supports small businesses is through its loan programs, which provide entrepreneurs with access to capital at competitive rates and favorable terms.

How Does an SBA Loan Work?

SBA loans are not provided directly by the Small Business Administration. Instead, the SBA partners with approved lenders, such as banks, credit unions, and non-profit organizations, to guarantee a portion of the loan.

This government guarantee reduces the risk for lenders, making them more willing to offer loans to small businesses that may not qualify for traditional financing.

To qualify for an SBA loan, a business must meet specific eligibility criteria, such as being a for-profit enterprise, operating in the United States, and meeting the SBA's size standards.

Also, the business owner must demonstrate a need for the loan, have invested their own time and money into the business, and have a solid credit history.

What is an SBA MicroLoan?

The SBA MicroLoan program is designed to provide small businesses and non-profit childcare centers with access to short-term, fixed-rate loans of up to $50,000. These loans are primarily intended for working capital, inventory, equipment, and supplies, but cannot be used for debt refinancing or real estate purchases.

SBA MicroLoans are provided through approved non-profit, community-based lenders known as intermediaries. These intermediaries receive funds from the SBA, which they then lend to eligible small businesses.

The MicroLoan program offers more flexible eligibility requirements compared to other SBA loans, making it an excellent option for startups, home-based businesses, and businesses with limited credit history.

How To Choose the Best Loan for Your Home Service Business

Let’s look at the most important factors to help you determine the best loan option for your business.

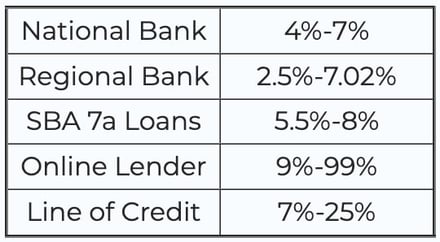

Interest Rates

Interest rates are a critical factor to consider when selecting a loan, as they directly influence the overall cost of borrowing. Lower interest rates translate to lower costs, making it easier for your business to manage loan repayments.

Source: LendThrive

Source: LendThrive

When comparing loan options, be sure to evaluate the Annual Percentage Rate (APR), which includes not only the interest rate but also any fees and charges associated with the loan. This will give you a clearer understanding of the total cost of borrowing.

Payments - When They Process & How Much They Are

Different loan options come with varying repayment terms and schedules, making it essential to understand the payment structure before committing to a loan.

Here, we'll explore various loan repayment options and discuss prepayment penalties.

1. Fixed Monthly Payments: Traditional loans typically involve fixed monthly payments based on the loan's principal, interest, and term.

2. Daily or Weekly Payments: Some lenders may require daily or weekly payments, often found in short-term loans or merchant cash advances. This repayment structure can be helpful for businesses with fluctuating revenues, as the repayment amount adjusts according to the business's income.

3. Percentage of Sales or Invoices: Alternative financing options like merchant cash advances and invoice factoring deduct a percentage of your daily sales or invoices, respectively.

4. Balloon Payments: Some loans come with a balloon payment structure, where smaller periodic payments are made throughout the loan term, followed by a large lump-sum payment at the end. This option may be suitable for businesses expecting a significant increase in revenue in the future. However, it's crucial to track your invoices and plan carefully and ensure you can make the balloon payment when it's due.

5. Interest-Only Payments: Interest-only payment plans involve making payments towards the interest of the loan for a specific period, with the principal amount repaid later.

6. Prepayment Penalties: A prepayment penalty is a fee charged by some lenders if you pay off your loan before the end of its term. Not all loans have prepayment penalties, but be sure to do your due diligence, as they can be a significant drawback, especially if you plan to pay off your loan early to save on interest costs.

Installment Loans Versus Lines of Credit

Installment loans and lines of credit are two common financing options for small businesses.

Installment loans provide a lump sum of money upfront, which is repaid over a fixed term with regular payments. This is ideal for businesses that need a substantial amount of capital for a specific purpose.

Lines of credit offer more flexibility, as they allow you to borrow and repay funds as needed, up to a predetermined credit limit. Interest is only charged on the amount borrowed, making it a cost-effective option for businesses with variable cash flow needs. Credit cards are the most common lines of credit.

Secured Versus Unsecured Loans

Secured loans require collateral, such as property or equipment, which the lender can seize if the borrower defaults on the loan. This added security reduces the lender's risk, often resulting in lower interest rates and better terms for the borrower.

Unsecured loans do not require collateral, making them a less risky option for borrowers. However, because they pose a higher risk to lenders, unsecured loans generally come with higher interest rates and more stringent eligibility requirements.

The Best Lenders for Home Service Owners

The Best Small Business Loans for Bad Credit: Uplyft

Uplyft Capital specializes in providing small business loans to borrowers with less-than-perfect credit scores. They offer a personalized approach to lending, evaluating each applicant's unique situation and potential for success. With flexible terms and fast funding, Uplyft offers the best small business loans for bad credit.

The Best Small Business Loans for Lines of Credit: Fundbox

Fundbox offers quick and straightforward lines of credit for small businesses, with a focus on simplicity and transparency. Their application process is user-friendly, and their credit decisions are typically made within hours. Fundbox is a great option for home service owners seeking flexible access to working capital.

The Best Small Business Loans for Equipment Financing: Triton Capital

Triton Capital specializes in equipment financing, offering customized loan options for businesses in need of new or upgraded equipment. With competitive rates and flexible terms, Triton Capital is an excellent choice for home service owners seeking to invest in equipment to grow their businesses.

The Best Short-term Loans: OnDeck

OnDeck is known for its short-term loans, providing businesses with fast access to capital for immediate needs. Their application process is simple and efficient, with funding available within 24 hours of approval. OnDeck is ideal for home service owners in need of short-term financing to address pressing business needs.

The Best Long-term Loans: Funding Circle

Funding Circle specializes in long-term loans, offering home service owners access to larger amounts of capital with repayment terms up to 10 years. Their transparent application process and competitive interest rates make Funding Circle a top choice for businesses seeking long-term financing.

The Best Working Capital Loans: National Funding

National Funding offers working capital loans specifically designed to help businesses cover day-to-day operational expenses. With fast approval and flexible repayment options, National Funding is an excellent choice for home service owners in need of extra capital to manage their cash flow.

The Best Business Lender for Microloans: Kiva

Kiva is a non-profit organization that provides interest-free microloans to small businesses worldwide. With a focus on community support and social impact, Kiva is an excellent option for home service owners seeking small amounts of financing to start or grow their businesses.

The Best Fast-funding for Small Business Financing: Kabbage

Kabbage offers fast and flexible financing for small businesses, with approval and funding often occurring within minutes. Their easy-to-use platform and line of credit options make Kabbage an attractive choice for home service owners who need quick access to funding to seize business opportunities or manage unexpected expenses.

Best Business Credit Card Lenders

Business credit cards are sometimes the best and only funding you may ever need. Reasons why these loans are a solid option include…

- Credit cards are revolving (meaning you can use them and pay them off as you need).

- They are unsecured loans (no collateral required).

- You can often get a starting 0% interest rate for anywhere from 6-24 months.

- By remaining in good standing, you can qualify for more promotions later.

- Business credit cards give you anywhere from $1,000 to $75,000 in available credit, with the option to increase your credit limit over time.

- Certain purchases give you rewards that can be highly lucrative.

Your Local Bank

Your local bank may offer business credit card options tailored to the needs of small businesses in your area. By choosing a business credit card from your local bank, you can benefit from personalized customer service, a local support network, and a better understanding of your community's unique business landscape.

Some banks may require you to set up a business bank account in order to apply for a business credit card, so be sure to check in with your local bank.

Local Credit Unions that Offer Business Accounts

Credit unions often provide competitive business credit card options, with lower interest rates and fees compared to traditional banks.

As member-owned organizations, credit unions tend to focus on serving their members' needs, which can result in favorable terms and a more personalized approach to customer service.

Capital One Spark

Capital One Spark business credit cards offer a range of rewards and cash-back options, making them an attractive choice for home service owners looking to maximize their returns on everyday business expenses.

With competitive interest rates, comprehensive fraud protection, and tailored card options, Capital One Spark provides a versatile solution.

Capital One does not require you to have a bank account with them in order to qualify for this card.

Chase Ink

Chase Ink business credit cards are known for their generous rewards programs and sign-up bonuses. With options to earn cash back, points, or travel rewards, Chase Ink cards offer home service business owners the opportunity to maximize the value of their business spending.

Chase does not require you to have a bank account with them in order to qualify for this card.

Bank of America Business Advantage

Bank of America's Business Advantage credit card lineup offers a variety of options, including cash rewards, travel rewards, and low-interest rate cards.

With features such as account management tools, expense tracking, and employee card controls, Bank of America Business Advantage cards provide home service owners with valuable financial management resources.

Bank of America does not require you to have a bank account with them in order to qualify for this card.

American Express Business

American Express Business credit cards are renowned for their exceptional rewards programs, travel benefits, and comprehensive purchase protection.

AMEX often charges annual fees for their business credit cards, however with their low-interest rates, high credit lines, and vast options for cash back, points travel rewards, American Express Business cards are often worth the cost.

They are a popular choice for home service business owners seeking a versatile credit solution.

In Conclusion

By carefully evaluating the features, terms, and conditions of each lending option, home service business owners can make informed decisions and select the most suitable financing solution to support their growth and success.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)