6 Ways to Reduce Online Payment Processing Fees

You don't have to deal with high payment processing fees. Learn how you can eliminate and reduce your online transaction costs!

Owning a business is great, but dealing with all the fees to run one...not so much. This is why you have to become a savvy entrepreneur who finds ways to cut costs wherever possible.

So why not begin with reducing your online payment processing costs? Depending on the provider you're using, you could be paying a large chunk of money per transaction (alongside monthly fees).

What if there was a way to lower or eliminate certain costs? Well, there are, and we're going to share a few.

But first, let's take a look at the typical payment processing fees local businesses deal with.

A Breakdown of the Costs for Digital Payment Processing

As a local business, you want to accommodate the needs of your customers to keep them coming back. This includes accepting credit cards and online payments.

It's an excellent idea to do this, but at what cost? Here's a look at what many payment processing companies charge:

- Transaction fees (a small percentage of each sale)

- Monthly plan fee (tiered, interchange-plus, or flat-rate)

- Account setup fee (one-time fee)

- Terminal purchase or lease fee (equipment to swipe credit cards)

- Monthly minimum processing fee (if you don't process enough transactions)

- PCI compliance fees

- Incidentals (disputes, chargebacks, and batch payment processing)

These can quickly add up to a hefty chunk of your revenue. So here's what you can do about it.

Mitigate Credit Card Fraud Risks Associated with Payment Processing

When your business poses a high risk for credit card fraud, you're going to face higher payment processing fees. The best way around this is to find ways to reduce this risk factor.

For instance, you can opt to accept more payments in person. If you want to allow more virtual payment processing, then you can ask your customers to enter their CVV or zip code.

This will allow the processor to validate the transaction easier. Then, in turn, you'll have a lower chance of dealing with chargebacks.

Eliminate Payment Processing Equipment

So you decide to mitigate credit card fraud by taking more payments in person. Does this mean you have to pay for payment processing equipment?

Not at all.

You can process payments virtually using a cloud-based gateway, such as contactless payment. All you need is your mobile device (smartphone or tablet) or even a desktop computer. Insert the credit card details of the customer, and you're all set.

Adopt an Address Verification Service

Here's another option you can use to mitigate the risks associated with processing payments for credit card transactions. With an address verification service (AVS), you can ensure the customer is the actual owner of the credit card.

The AVS will verify the billing address entered with the card issuer. If it comes back incorrect, then the transaction will be declined.

Avoid Payment Processing Companies that Charge Unnecessary Fees

If you don't read the fine print of the contract you enter into with a payment processing service, you could end up paying for more than you should. That's because many payment gateways aren't forthcoming about their fees.

What you want to look for are non-processing fees. This includes costs for non-transactional things like:

- Account maintenance

- Minimum processing fee

- Terminal rental

- Statement fee

- Regulatory product fee

- PCI non-compliance fee

- PCI annual fee

And the list goes on. Then it's also ideal to go with a payment processor with favorable transactional fees.

Choose a Virtual Payment Processing Provider

Not all online payment processing services are golden tickets. Many of them do charge hidden fees, which means you'll have to do your due diligence.

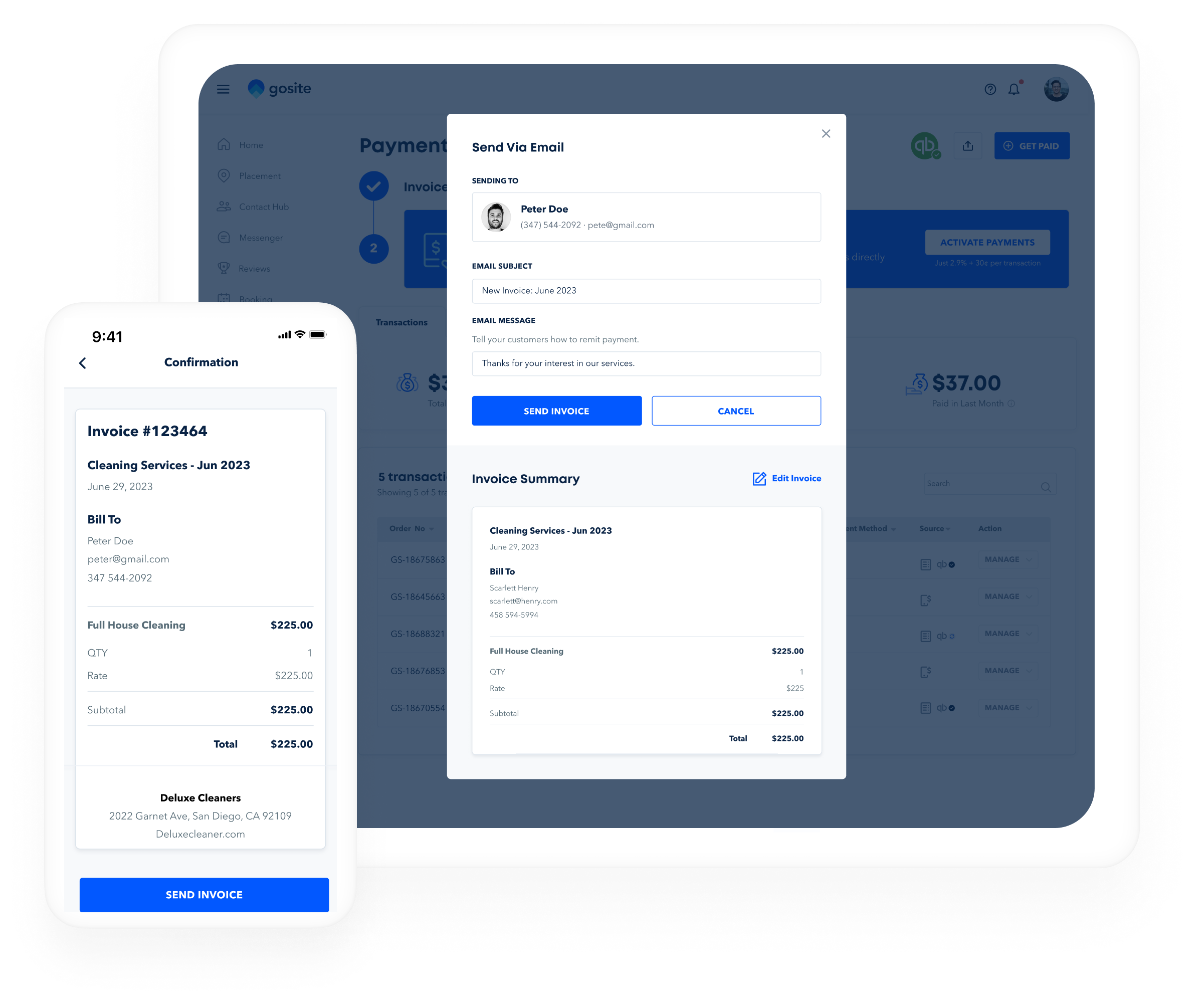

The goal is to select a virtual payment processing provider that's affordable. With the GoSite payment tool, you get the opportunity to pay lower transactional fees that many others charge.

Try GoSite Payments & Invoicing for FREE!

Try GoSite Payments & Invoicing for FREE!

For instance, major payment gateways charge 2.9% + $.30. However, GoSite only charges 2.65% + $0.15.

You can do the math based on the monthly transactions you process. Plus, there are minimal other fees to worry about.

Don't Become a Victim of High Payment Processing Fees

Local businesses are prone to fall victim to online payment processing services that overcharge. The online world normally isn't their domain, so they end up choosing the first provider they come across.

They're ill-aware of what to look for and what to avoid -- but not your business. You now have insights you can use to make an informed decision.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)