7 Key Practices for Better Invoice Management

Have you been struggling to keep track of the inflows and outflows of cash generated from your small business? Uncover strategies to better manage invoices effectively.

Invoice management is essential for your small business. Aside from helping you track your cashflow, it also speeds up your payment process.

Whether your business delivers products to customers or offers services to clients, it's crucial to understand invoice management processes and discover the best practices to manage your invoicing effectively.

Paper invoicing errors cost companies $53.50 to fix on average. - Industry Week

In this article, we'll explore the invoice management processes and the best practices to manage invoices efficiently.

Jump to:

-

What Is Invoice Flow Management?

-

A Breakdown of the Invoice Management Process

-

Great Invoice Examples and Templates

-

7 Best Practices To Help You Effectively Manage Invoicing

-

Better Understand the Financial Health of Your Business With an Invoice Management System

What Is Invoice Flow Management?

Invoice flow management comprises several steps needed to manage invoices and payments. Invoice management deals with managing incoming invoices from vendors and generating and sending invoices to clients and customers.

Invoice flow management covers how businesses send invoices to their clients for goods and services purchased, receive invoices, and make payments to contractors and suppliers for inventory received.

Invoice management is a two-way process. You have to effectively manage incoming invoices from your suppliers to maintain a great working relationship while simplifying your invoicing processes to suit your customers and speed up their payments. Source: Basware

Source: Basware

A Breakdown of the Invoice Management Process

The invoice management process covers account payables and account receivables procedures. As earlier stated, managing invoices and payments includes calculating invoices for customers on purchased products and services and processing invoices received from contractors and suppliers.

Invoice processing means the steps connected to invoice management, from billing to making payments. The invoice process isn't as complex for small businesses yet; 27% of small and medium-sized enterprises stated they have difficulty generating and delivering invoices.

However, with the correct invoice management system, you can manage your invoices processes seamlessly.

Here is a breakdown of the invoice management process:

1. Billing

Billing entails issuing invoices to customers to request payment for purchases made. It's the process of creating and issuing invoices to your clients. You can send invoices to your customers or receive a bill from your vendors.

Contractors and suppliers send their invoices on the completion of their services to demand their payments. Bills exist in different forms—physical or written documents, or electronic format.

The billing process comprises three stages:

Review Billing Information

This is the first stage of the billing process. It involves collecting all the information required to create your bill. To review a bill, you'll need to check the product code and ensure the price is accurate, verify tax, add shipping charges, and confirm agreed payment terms whenever relevant.

Generate the Invoice

The next stage in the billing process includes creating an invoice with the reviewed information. You can use a free invoice template or opt for invoicing software to automate invoice generation.

Invoicing software allows you to select an invoice template, customize it to suit your brand style, insert your business information, and send it.

Send Out the Invoice

Invoice sending is the final stage in the billing process. You can choose to send Invoices through invoice email or via invoicing software.

Invoice management software is an easy and effective way of sending invoices to clients. Invoice management software enables you to automate your billing processes.

Some benefits of invoice software include:

- Personalized templates for different clients

- Provides better invoice management.

- Eliminates overbilling as a result of duplicate invoices.

- Removes the need for paper invoices.

- Generates automatic reminders of payments of invoices.

- Saves time and resources.

2. Payment

Invoice payments sum up the payments you make to your contractors and vendors. Timing is crucial in invoice payment, so you need to implement a payment system to notify you of payment dates. Late payment can affect your relationship with your vendors and harm your goodwill.

Incorrect invoices cause 61% of late payments. - Sharespace

A working payment system ensures early payments, improved cashflow, and better relationships with your vendors. Once you review and confirm the invoice, make payment immediately. Business leaders usually make early payments to benefit from a discount offer or bonuses.

3. Receipt

A receipt is proof of payment for a product or service. Suppliers use receipts as a document to prove a cash sale or an invoice payment. They also use it to track their transactions. Generally, you issue receipts after you verify payment.

After you confirm your customers' payment, you'll issue them a receipt as proof that they've paid the invoice you sent.

Here are some components of a receipt:

- Company Information: Shows the firm's name, address, and cell phone number.

- Date: Shows the day the receipt was issued. The date should be the day a client paid or close to the day.

- List of products or Services: Outline each good or service provided to the customer and the cost for each line item.

- Additional Fees: List taxes and delivery fees as different line items and part of the total payment amount.

- Total Payment Amount: After you mail an invoice to your customers, confirm if the full payment value corresponds with the total invoice and if there were no modifications or alterations.

4. Auditing Invoices

Invoice auditing is an extensive inspection of invoices received from vendors. Auditing helps you uncover errors, rectify overcharges, and ensure compliance with agreements on prices, quantity, and promised discounts.

It enables you to manage invoices and payments effectively while tracking mistakes in your invoice payment. Such disparities can reduce your profit margins and eat into your business capital. Unidentified loopholes in received invoices can affect your business in no small measure.

You may incur losses when your supplier overcharges on your purchases or ignores an approved discount, failing to review your invoice. Auditing enables you to monitor your suppliers to ensure they adhere to agreed rates.

Great Invoice Examples and Templates

Here are two templates we created for you to customize for your business. When you open the template, be sure to click “File” and “Make a copy” to get started. Add your company logo, colors, and fonts to create a branded document.

Edit and Download Template 1 (see below)

Edit and Download Template 2 (see below)

7 Best Practices To Help You Effectively Manage Invoicing

Here are strategies that will help you manage invoicing effectively:

1. Define the Roles Within Your Department

Create a system that defines the roles of every employee. Employees are to have well-defined roles for accountability and thorough reviews. When you separate duties among your workers, it boosts the smooth running and control of your accounts payable department.

Opt for expert guidance for employee training to increase proficiency and set clear guidelines to ensure regulated tasks and responsibility. Share duties among employees to avoid cases where a single staffer handles all steps, causing delays that affect cashflow when the employee is unavailable.

Clearly defined functions ensure your employees know your expectations for each task. Don't expect your workers to figure out their duties. Take practical steps in organizing your team and increase their efficiency and effectiveness.

2. Establish Workflow and Internal Processes

Establish a consistent workflow process to streamline the payment approval process. Your workflow process affects the efficiency of your business. The more vague your workflow is, the more its potential for errors or delayed payments.

Review your existing workflows and note the areas to make improvements. The best invoice management systems allow you to improve your workflows with automation. With automation, you get to notify your employees of their assigned tasks. Once the task is completed, you'd get updates on the performed task.

Source: Quickbooks

Incorporating Internal controls in your account payable (AP) department is essential to monitor workflow processes to avoid fraud. Employees who have access to a vendor's payment process may exploit their role.

Separation of responsibility within the AP unit and including internal controls prevents employees' limitless access allowing you to track and control every payment. Also, an internal review process reveals your team's efficiency in filling invoice information.

3. Ditch Paper Invoices

Paper invoices are outdated, and smart businesses are switching to e-invoicing methods. Asides from the convenience of electronic invoice management systems, it also improves your account security. E-invoices also help to reduce fraud tendencies through their use of digital signatures and quick transfer.

Aim to leverage artificial intelligence in your invoice workflow. With e-invoices, you get to skip the process of generating and delivering paper invoices. Some invoice systems also allow you to receive payment instantly.

Paper records are time-consuming and easily misplaced: 66% of businesses using paperwork are at risk. Paper records aren't needed because you can perform audits on your software systems.

Utilizing an invoice management system reduces the bottlenecks attributed to paper invoices. It also relieves your employees of the stress of manually tracking invoices.

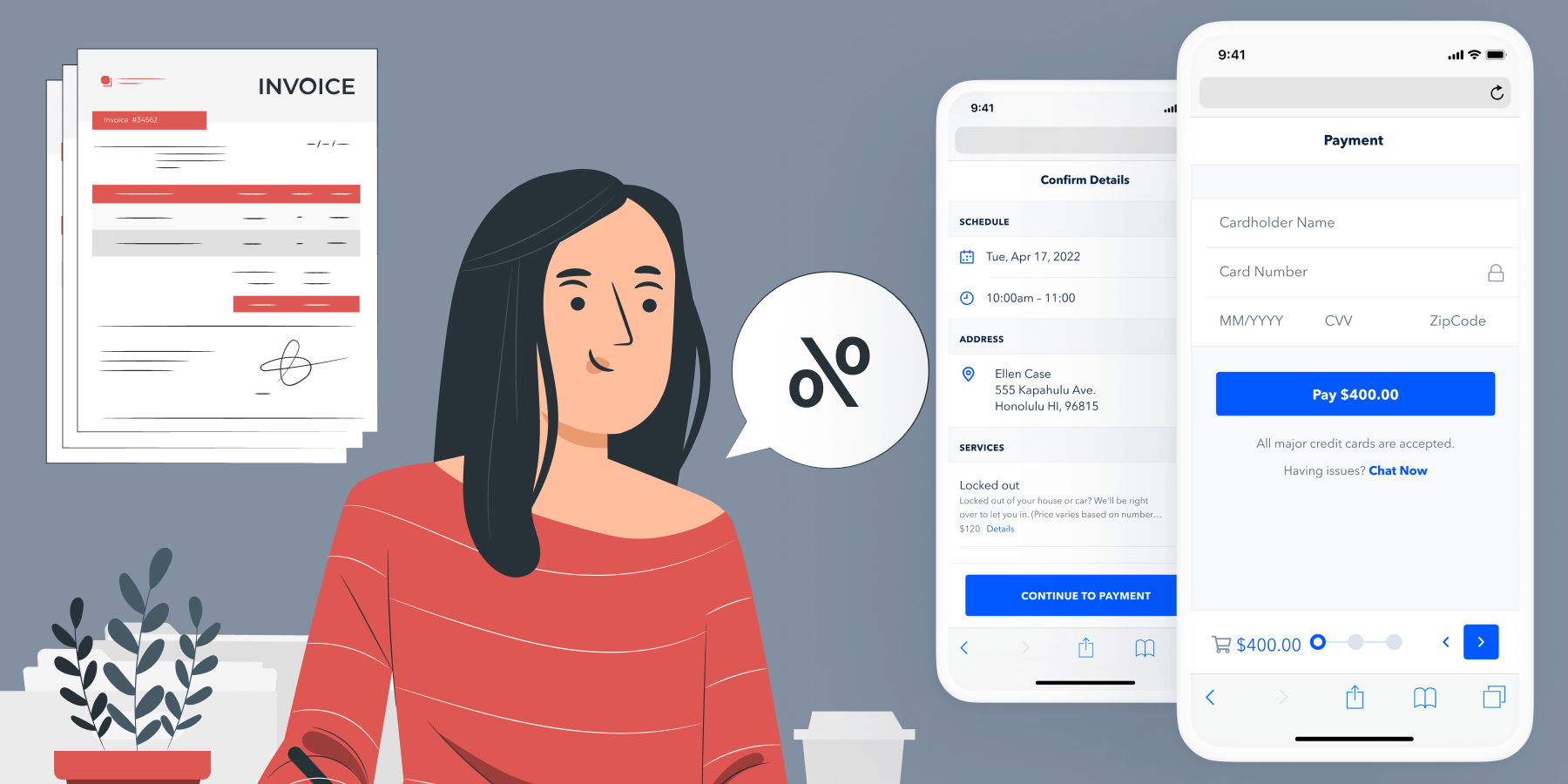

Example of Automated Invoicing

Using GoSite’s invoicing tool as an example, you can see how replacing your paper invoices with digital invoices simplifies the process.

When you draft your invoice, you can decide how to send them, such as via email, text, or both.

Digital invoices ensure accuracy and deliver professional-looking invoices automatically, which saves you and your employees time.

You can even customize your list of services with a digital invoicing tool so that you can item charges according to your price sheet without having to fill out each entry manually. After delivering your invoice digitally, you can set up reminders and check payment statuses in real time.

4. Eliminate Manual Processes

Imagine you invest the time you would have spent manually managing invoices in other areas of your business. You will surely increase your productivity. Simplifying processes with automation is the best thing to happen to any business.

Manual invoice processing is laborious and prone to human error and fraud. Plus, it delays invoice and payment processes.

In managing invoices manually, you add and review every detail manually. Afterward, you'll need to send your clients reminders to complete the invoice and process payment.

Other challenges of manual processes include:

- Slow invoice approvals

- Late payments

- Limited insight into the account management process

- Missing invoices

- Duplicate payments

- Human errors

5. Streamline Approval Workflows by Automating Invoice Management

Nearly 80% of businesses already enjoy the benefits of invoice automation and hope to boost their investments shortly. Automating your Invoice process is an excellent option for making fast payments on invoices and sending invoices to clients. Physical paper invoices can easily get lost at any point in the invoicing process and can delay payments.

Invoice software for small businesses can help identify invoice errors from vendors or client payments. You can resend unpaid invoices and track your customer's payment history. Improve your invoicing process—automate your business's invoice processing workflow.

The invoice approval workflow comprises a series of exercises to review an invoice and confirm that there are no disparities between the invoice and the initial purchase record.

Here are other benefits of streamlining your invoice management process:

- Save time.

- Verify invoices faster with automated notifications

- Eliminate the possibility of missing documents.

- Eliminate late payments, and enjoy early payment discounts.

- Build better relationships with vendors

- Eliminate human errors.

6. Provide Customers With an Itemized Invoice to Better Understand Charges

Ensure your invoice states the billing, the products or services delivered, and the time. Your customers need to understand what they are paying for.

It's crucial to create a decent-looking and readable invoice. You can adapt invoice software to create professional-looking software.

Clearly outline the descriptions of each job or product for better insight. You can break down larger projects into smaller ones with their costs for your customers to understand their bills.

When your clients understand your invoice, they can quickly proceed to make payments smoothly without delay or need further clarification. Faster payments mean higher income flow for your business.

7. Avoid Late or Overdue Payments With Payment Reminders

Early reminders are necessary to prompt early payment. Send invoices early to your clients to avoid late charges. Until your customers receive their invoices, they can't make payments. Late invoices can cause complications since some clients forget to complete such transactions.

Your client may have other vendors and different invoices to settle. It's advisable to send reminders to customers. You can send reminders manually or automate them with invoicing software.

The best invoice management software will help you automatically send timely reminders to your clients. Early reminders lessen the case of delays in payment for your services.

Better Understand the Financial Health of Your Business With an Invoice Management System

Innovative businesses are modifying their invoice management processes. Generally, small businesses have limited cash reserves. They are primarily concerned about their cashflow resulting in more attention to their payment receivable with little attention to bills to be paid.

An invoice management system provides a platform to process your account payables and account receivables. It's an all-in-one platform that enables you to manage incoming and delivered invoices. When you have a detailed insight into your cashflow, you can quickly know the financial state of your business.

You can make the best-informed decisions for your business with detailed knowledge of your cashflow. However, as early payments are necessary to maintain good relationships with vendors and suppliers, neglecting your account receivable can result in late payments from clients.

GoSite is an all-inclusive platform that helps you gain and manage clients. Its digital payment options allow you to request and receive payments faster. Generate and send invoices to your customers within seconds with GoSite.

%20(1)%20(1).png?width=340&name=Group%2012%20(2)%20(1)%20(1).png)